Energy Wholesale Market Review

Energy Wholesale Market Review Week Ending 29th June 2018

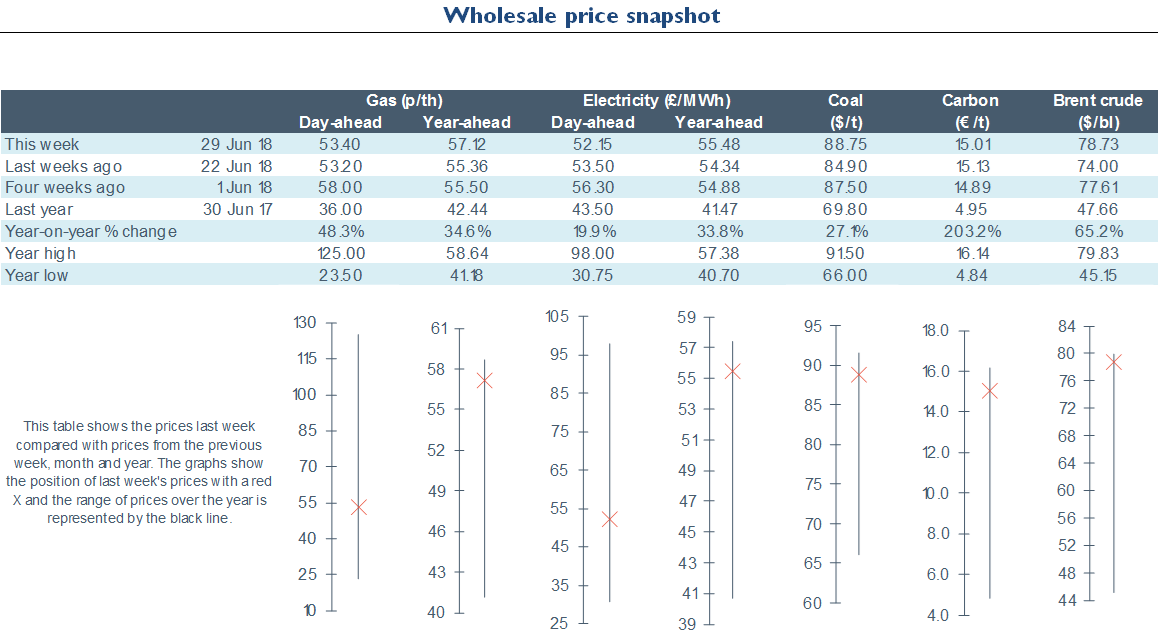

Day-ahead gas prices boosted 0.4% to 53.4p/th with higher national system demand amid soaring temperatures, and as gas for power demand increased due to a fall in wind output. Day-ahead power prices continued to fall, down 2.5% to £52.2/MWh. Although wind output plummeted last week, down to 5% of the generation mix from 18% the previous week, solar PV has set new records, generating 533GWh between 21-27 June. All seasonal gas and power contracts increased this week. Seasonal gas contracts leapt 3.6% on average, with winter 18 gas experiencing the least change, up 2.3% to 63.9p/th. Seasonal power contracts went up 2.3% on average. Oil prices rose throughout the week. Supply disruptions have occurred at Canada’s Syncrude oil production facility, taking 350,000 bpd offline, with expectations for the closure to remain throughout July. The upcoming sanctions placed on Iran by the US, coupled with the US-China trade war, is creating uncertainty for demand, with major economies unsure of future economic growth amid worries of high tariffs on exports. API 2 coal has continued to fall from recent highs, dropping 1.0% to $86.7/t. The ongoing US-China trade dispute is creating uncertainty for US coal-miners, delaying supply contracts after the commodity was added to the list of over 650 items facing increased tariffs from China.

Energy Wholesale Market Review Week Ending 29th June 2018

Energy Wholesale Market Review Week Ending 22nd June 2018

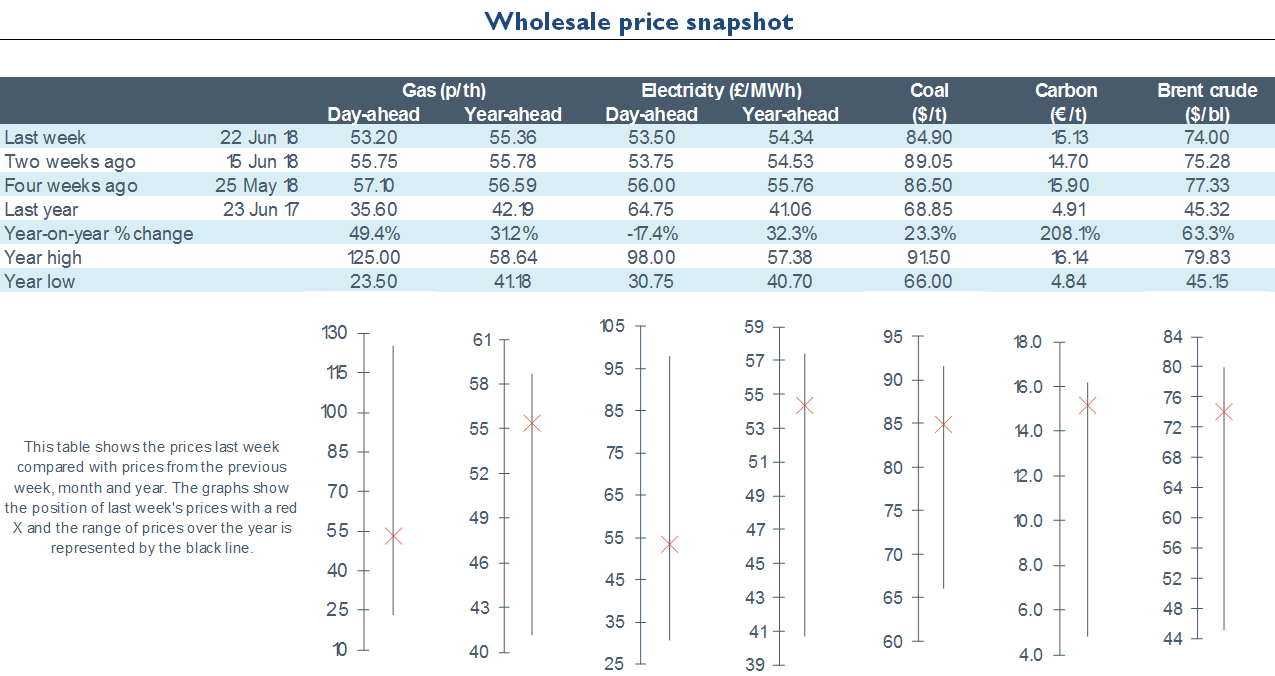

Near-term gas and power prices fell for the second week, continuing to be driven by forecasts of high wind generation, an oversupplied gas system, and a decline in Brent crude oil and EU ETS carbon prices. Day-ahead gas prices dropped 4.6% to 53.2p/th as an ongoing outage at the IUK and lower demand left the gas system oversupplied all week. Day-ahead power fell 0.5% to £53.5/MWh, following its gas counterpart, with high levels of renewables output further depressing spot prices towards the end of the week. Month-ahead power (July 18) also fell, down 1.9% week-on-week to £52.9/MWh. All seasonal gas contracts declined this week, falling 0.3% on average. Winter 18 gas saw the largest change, down 1.1% to 62.4p/th amid increased supply security as gas storage injections pushed UK storage capacity to 40% full. The majority of seasonal power contracts went down this week, with summer 19 and winter 19 power being exceptions, both rising 0.1% to £48.7/MWh and 54.5/MWh respectively. Oil prices fluctuated throughout this week in the run up to OPEC’s meeting in Vienna on 22 June to discuss current production cuts. The outcome of the meeting was an agreement to raise production by 1mn bpd. Brent crude prices fell 1.7% week-on-week to $74.0/bl. EU ETS carbon prices averaged €14.7/t this week, 3.7% below the previous week’s average. EUA prices hit a one-month low in the middle of the week at €14.5/t.

Energy Wholesale Market Review Week Ending 22nd June 2018

Energy Wholesale Market Review Week Ending 15th June 2018

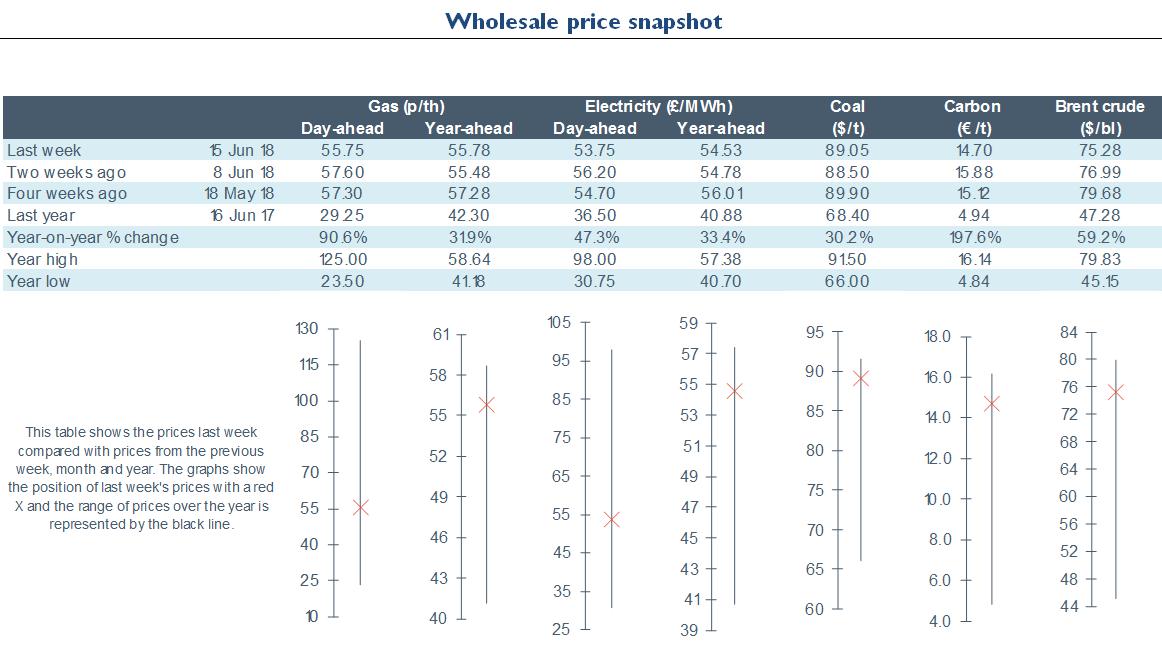

Gas and power contracts showed mixed movements this week. Near-term prices fell, driven by forecasts of high wind generation, an oversupplied gas system, and a decline in commodity prices. Day-ahead gas dropped 3.2% to 55.8p/th, caused by lower demand and a planned IUK outage which is acting to decrease gas export capacity and lifting available supplies. Day-ahead power closely followed gas prices down, falling 4.4% to £53.8/MWh. In addition, high levels of renewables output depressed spot power prices towards the end of the week, even leading to negative system prices on the Balancing Mechanism. The majority of seasonal gas contracts rose this week, with summer 19 gas the exception, falling 0.2% to 48.4p/th. Nearly all seasonal power contracts declined this week. Winter 18 power was the exception, rising 0.2% to £60.5/MWh. Oil prices have begun to stabilise after recent volatility. Week-on-week Brent crude oil prices have fallen by 2.2% to $75.3/bl, amid expectations that Saudi Arabia and Russia will ease the current supply restrictions at an OPEC meeting on 22 June. EU ETS carbon prices fell 2.8% to average €15.3/t this week, owing to reduced spreads for coal-fired output in Germany. In addition, a provisional agreement from EU lawmakers could see the renewable energy target increased from 27% to 32% for 2030, which could depress prices in the future.

Energy Wholesale Market Review Week Ending 15th June 2018

Energy Wholesale Market Review Week Ending 8th June 2018

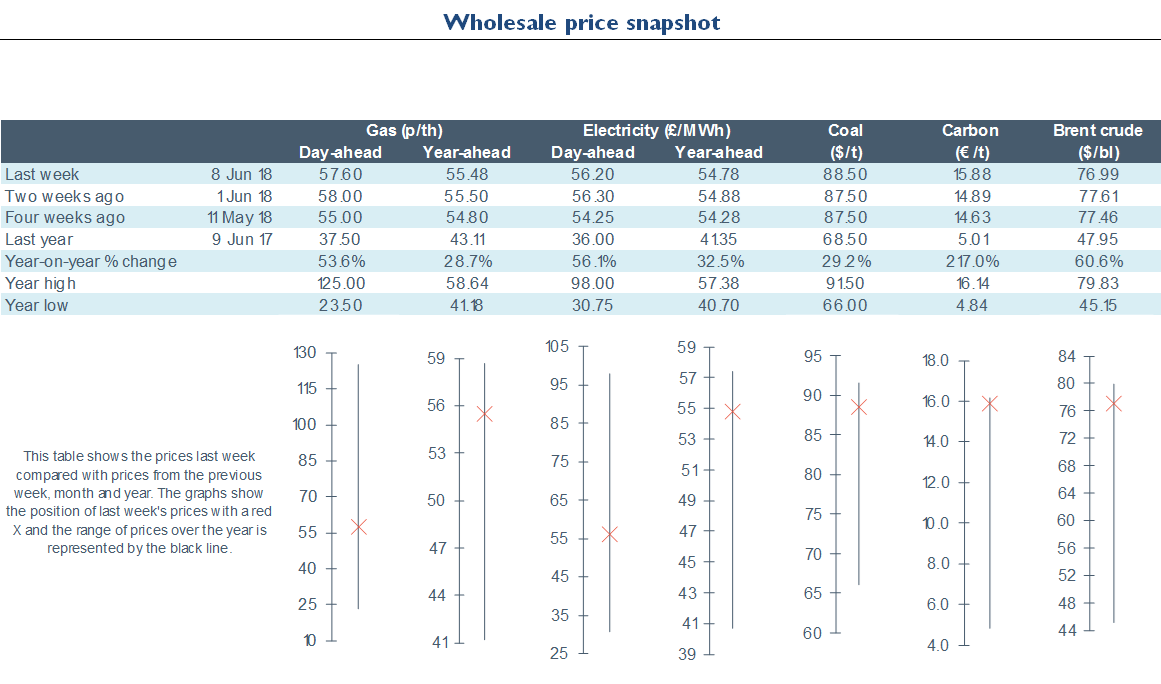

Day-ahead gas prices dropped 0.7% week-on-week to 57.6p/th. The week started with rising prices as the system was undersupplied with lower wind output leading to an increase in gas demand for electricity generation. Despite rising demand forecasts through to Thursday, prices dropped as temperatures rose towards the end of the week causing lower demand than expected. Day-ahead power prices closely followed its gas counterpart down, falling 0.2% to £56.2/MWh week-on-week. Month-ahead power (July 18) also fell, down 3.5% week-on-week to £54.5/MWh. Winter 18 gas was the only seasonal gas contract to drop this week, falling 1.8% to 62.5p/th. The decrease in price came as European gas stocks have been refilled at record levels and amid a fall in oil prices. Winter 18 power followed its gas counterpart, lowering 1.1% to £60.3/MWh. Oil prices have continued to fluctuate in response to ongoing geopolitical tensions between the US and OPEC nations, including Venezuela and Iran. Week-on-week Brent crude oil prices have fallen by 0.8% to $77.0/bl, with an increase in US crude oil well production being a key driver. EU ETS carbon prices rose 6.6% week-on-week to €15.9/t. Prices hit a fresh seven-year high on 5 June at €16.7/t and are currently more than triple their level this time last year. Carbon prices have risen amid a reduction in the number of surplus carbon allowances in the market and the upcoming implementation of the 2019 Market Stability Reserve which could see the availability of EUAs cut.

Energy Wholesale Market Review Week Ending 8th June 2018

Energy Wholesale Market Review Week Ending 1st June 2018

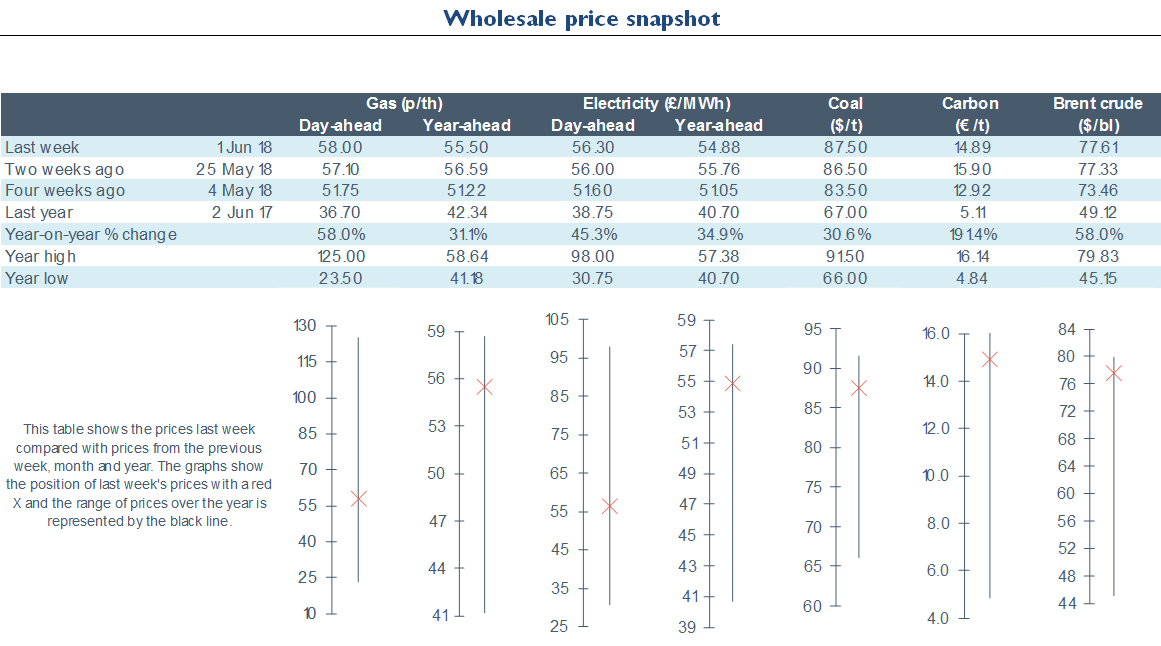

Commodity markets remained a key driver behind movements in power and gas contracts this week, with oil and carbon markets ending May with volatile behaviour on the back of heightening geopolitical tensions. After oil prices saw their first weekly loss in nearly two months last week, oil prices fluctuated throughout this week showing no clear direction as they responded to tensions between the US and OPEC nations. OPEC suggesting that it would relax production cuts to replace a potential reduction in exports from Iran and Venezuela meant that Brent crude prices averaged 2.5% below the previous week at $76.7/bl. A report of rising US output forecasts from the EIA could result in Brent crude prices falling in June. EU ETS carbon prices set a fresh near-seven-year high of €16.6/t on 29 May, the highest since June 2011. Prices fell €1.0/t within-day on 31 May due to the heavy selling of allowances by market participants following President Trump’s decision to impose steel and aluminium tariffs. Day-ahead gas rose 1.6% week-on-week to 58.0p/th. The week started with falling prices despite planned outages and forecasts of rising gas demand for power generation as wind output dropped. The system was undersupplied towards the end of this week leading to prices recovering earlier losses. Day-ahead power mirrored its gas counterpart upwards, rising 0.5% to £56.3/MWh week-on-week. Month-ahead power (July 18) also increased, gaining 1.4% week-on-week to £56.4/MWh.

Energy Wholesale Market Review Week Ending 1st June 2018

Written By Graham Paul