Glossary

- AA

See Annualised Advance

- AAHEDC

See Assistance for Areas with High Electricity Distribution Costs Scheme

- Access Point

The node on the Network Service Provider’s infrastructure excluding the Local Communications Link and Gateway by which the Network Service Provider provides the Data Transfer Network.

- Active Energy

The electrical energy produced, flowing or supplied by an electric circuit during a time interval, being the integral with respect to time of instantaneous Active Power, measured in units of watt-hours or standard multiples thereof.

- Active Power

Product of voltage and the in-phase component of altering current measured in units of watts and standard multiples thereof, that is:

1000 Watts = 1kW

1000 kW = 1 MW

- AD

Anaerobic Digestion

- AMO

See Association of Meter Operators.

- AMR

Automated Meter Reading - automatic collection of data from meters which is transferred to a central database for billing and/or analysis.

- Annualised Advance

An AA is the annualised (12 months) consumption of a customer that does not have a half hourly metering system. AA is the ‘rate of consumption in the meter read period’ expressed in kWh. It is derived from profile information and the meter advance for a period spanning the day for which the AA is calculated. The AA is generated by the Data Collector and sent to NHHDAs. It is used by the Initial Settlement & Reconciliation Agent when determining the consumption of non-half hourly customers.

- APX

APX Group is a holding company owning and operating energy exchange markets in the Netherlands, UK and Belgium. APX-ENDEX, a subsidiary of APX Group, provides exchange trading, central clearing & settlement and data distribution services.

- Arbitrage

The difference in price of a given commodity either in the same location or in different geographical locations. Grade arbitrage is trading the difference in the price of a commodity in the same location – e.g. the difference in the prices of two sweet crudes in northwest Europe. Geographical arbitrage is trading the difference in the price of the same grade on difference locations. Often grade and geographical arbitrage are combined – e.g. in transatlantic arbitrage which is trading the price difference between, for example, Brent crude in Europe and West Texas Intermediate in the US this calculation will include the cost-of-carry as well as the cost of the alternative crude in the US.

- Assistance for Areas with High Electricity Distribution Costs Scheme

The Assistance for Areas with High Electricity Distribution Costs Scheme was introduced in the Energy Act 2004. The intention of the Scheme is to reduce the costs to consumers of the distribution of electricity in certain areas. Currently the only Specified Area is the North of Scotland. National Grid therefore recovers an Assistance Amount through the Scheme, which is passed to the Relevant Distributor in the Specified Area, Scottish Hydro Electric Power Distribution Ltd. This enables distribution charges to be reduced.

AAHEDC Tariffs - For more information on the National Grid website

- Association of Meter Operators

Data Collectors, Meter Operators and Data Aggregators: The Association of Meter Operators (AMO) is the trade association representing it members.

- Backwardation

Term used to describe an energy market in which the anticipated value of the spot price in the future is lower than the current spot price. When a market is in backwardation, market participants expect the spot price to go down. The reverse situation is described as contango.

- Balancing Market

The market run by NGC using the Bids and Offers received to determine the most economic way to balance the system.

- Balancing Market Unit (BMU)

The smallest trading block in the electricity generation and supply system that can operate independently and for which only one party is responsible.

- Balancing Mechanism Unit

Balancing Mechanism (BM) Units are used as units of trade within the Balancing Mechanism. Each BM Unit accounts for a collection of plant and/or apparatus, and is considered the smallest grouping that can be independently controlled. As a result, most BM Units contain either a generating unit or a collection of consumption meters. Any energy produced or consumed by the contents of a BM Unit is accredited to that BM Unit

- Balancing services use of system changes (BSUoS)

The means by which the transmission system operator recovers elements of the costs of running the transmission system.

National Grid recovers the costs of balancing the System through BSUoS charges.

The Statement of the Use of System Charging Methodology includes a detailed methodology for the calculation of daily BSUoS charges, some worked examples, and information on timing of BSUoS Charges and financial settlement.

The Statement of the Balancing Services Use of System Charging Methodology can be found here: https://www.nationalgrideso.com/charging/balancing-services-use-system-bsuos-charges- Barrier to Entry

A factor that may restrict a firm‘s entry into a market.

- Baseload product

A product which provides for the delivery of a flat rate of electricity in each hourly period over the period of the contract.

- BCA

Bilateral Connection Agreement

- Bearish Sentiment

Where market conditions suggest that prices are likely to fall.

- BEGA

See Bilateral embedded generation agreement

- BERR

Department of Business Enterprise and Regulatory Reform

- BETTA

See British electricity trading and transmission arrangements (BETTA)

- Bid-offer spread

Bid-offer spread shows the difference between the price quoted for an immediate sale (bid) and an immediate purchase (offer) of the same product; it is often used as a measure of liquidity.

- Bids and Offers

An indication of a willingness to reduce (bid) or increase (offer) the level of generation or increase (bid) or reduce (offer) the level of demand submitted to the balancing mechanism.

- Big 6

The name collectively given to the six companies that supply most of the energy to domestic households in the GB market. They are Centrica, E.ON, Scottish and Southern Energy, RWE Npower, EDF and Scottish Power.

- Bilateral

Refers to two parties. Normally used in connection with trading whereby two parties (for example a generator and a supplier) enter into a contract to deliver electricity at an agreed time and price in the future.

- Bilateral Credit Arrangements

An arrangement to provide credit agreed directly between two counterparties, rather than through an exchange or clearing house.

- Bilateral Embedded Generation Agreement

A form of bilateral contract between NGC and a licence-exempt distributed generator.

- BM

Balancing Mechanism

- BMRS

Balancing Mechanism Reporting System

- BOA

Bid-Offer Acceptance

- BOM - Balance of Month

Balance of Month - relates to gas or electricity for delivery in the remainder of the current calendar month.

- BPS

Balancing Principles Statement

- British Electricity Trading and Transmission Arrangements (BETTA)

The commercial and practical arrangements for trading and balancing which apply to the whole of Great Britain from April 2005.

- Broker

A broker handles and intermediates between orders to buy and sell. For this service, a commission is charged which, depending upon the broker and the size of the transaction, may or may not be negotiated. AKA Third Party Intermediary - TPI

- BSAD

Balancing Services Adjustment Data

- BSC

Balancing & Settlement Code

- BSCC

Balancing Services Contracts Costs

- BSCCo

Balancing and Settlement Code Company

- BSCP

Balancing and Settlement Code Procedure

- BSUoS

See Balancing services use of system changes

- Building Energy Management System

A building energy management system (BEMS) is a sophisticated method to monitor and control the building's energy needs. Next to energy management, the system can control and monitor a large variety of other aspects of the building regardless of whether it is residential or commercial. Examples of these functions are heating, ventilation and air conditioning (HVAC), lighting or security measures. BEMS technology can be applied in both residential and commercial buildings.

- Bullish Sentiment

Where market conditions suggest that prices are likely to rise.

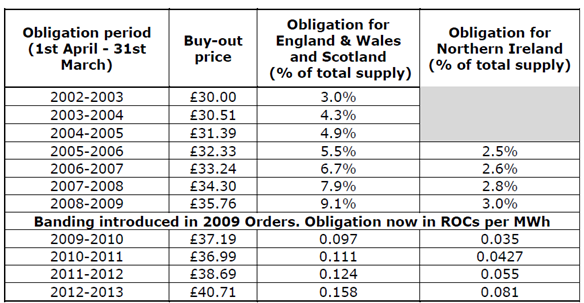

- Buy Out Payments

The payments made by suppliers who did not submit sufficient Rocs to meet their targets for Renewable Obligation.

- CADL

Continuous Acceptance Duration Limit

- CALF

See Credit Assessment Load Factor

- Call Option

An option that gives the buyer (holder) the right, but not the obligation, to buy a futures contract (enter into a long futures position) or physical commodity for a specified price within a specified period of time in exchange for a one-time premium payment. It obligates the seller (writer) of the option to sell the underlying futures contract (enter into a short futures position) or commodity at the designated price, should the option be exercised at that price.

- Capacity

In reference to electricity, the maximum load that a generating unit or generating station can carry under specified conditions for a given period of time without exceeding approval limits of temperature and stress.

- Capacity Mechanism

A capacity mechanism explicitly rewards the provision of capacity. Proposals for a capacity mechanism were part of the Government‟s Electricity Market Reform (EMR) consultation document, and the July 2011 publication of the EMR White Paper confirmed that a capacity mechanism would be implemented.

- Carbon Reduction Commitment

The Carbon Reduction Commitment (CRC) is an innovative climate change and energy saving scheme for the UK. It will encourage improvements in energy efficiency which can save organisations money. The scheme has been designed to generate a shift in awareness in large organisations especially at senior level, and to drive changes in behaviour and infrastructure.

The scheme is also a central part of the UK’s strategy for controlling our carbon dioxide (CO2) emissions. It will tackle CO2 emissions not already covered by Climate Change Agreements and the EU Emissions Trading System. This will help reduce the country’s carbon footprint to deliver the ambitious emissions reduction targets set in the Government’s Climate Change Act. The scheme started in April 2010

- Cash-Out Arrangements

Arrangements whereby generators and suppliers pay or are paid for imbalances i.e. shortages and surpluses of power relative to their contracted commitments.

- CCGT

See Combined Cycle Gas Turbine

- CCL

See Climate Change Levy

- CCS Gateway

EDW Technology software solution supporting the OFGEM Faster Switching Programme. CCS Gateway is an adapter connecting suppliers to the Central Switching Service (CSS).

- CDCA

Central Data Collection Agent

- Central Switching Service

Ofgem’s Faster Switching Programme which entails the creation of a Central Switching Service (CSS) across gas and electricity supplies. The objective is to achieve capability for next-working-day switching for gas and electricity by 2022.

- CfD

Contract for Differences - A contract designed to make a profit or avoid a loss by reference to movements in the price of an underlying item. The underlying item is not bought or sold itself.

- CfD

Contract for Difference

- Change of Tenancy

Current customer has moved away and new occupier is present at the supply point.

- CHP

See Combined Heat & Power

- Churn rate

Churn is typically measured as the volume traded as a multiple of the underlying consumption or production level of a commodity.

- Clean Spread

The generating margin for Gas and Coal Fired electricity plant after the cost of EU-ETS carbon allowances has been removed.

- Clearing

The process by which a central organisation acts as an intermediary and assumes the role of a buyer and seller for transactions in order to reconcile orders between transacting parties.

- Clearing House

An organisation which guarantees the performance and settlement of futures and options contracts, e.g. the London Clearing House in London or the Options Clearing Corporation in Chicago.

- Climate Change Levy

A tax on the supply of electricity and gas collected by Suppliers from business consumers.

- Clip size

The size (usually in MW) of the contract to be traded.

- CMRS

Central Meter Registration Service

- Cogeneration

The simultaneous production of electricity and another form of useful energy (such as heat or steam) through the sequential use of energy, resulting in increased efficiency of fuel use.

- Collateral

An obligation or security linked to another obligation or security to secure its performance.

- Combined Cycle Gas Turbine

A gas fired electricity generation plant.

- Combined Heat & Power

Simultaneous generation of usable heat and electrical power in a single process. A generating facility that produces electricity and another form of useful thermal energy (such as heat or steam) used for industrial, commercial, heating or cooling purposes.

- CoMC

Change of Measurement Class

- Commodity Future

A futures contract on a commodity. Unlike financial futures, the prices of commodity futures are determined by supply and demand rather than the cost-of-carry. Commodity futures can, therefore, either be in contango (where futures prices are higher than spot prices) or backwardation (where futures are lower than spot prices).

- Commodity Swap

Commodity swaps enable both producers and consumers to hedge commodity prices. The consumer is usually a fixed payer and the producer a floating payer. If the floating-rate price of the commodity is higher than the fixed price, the difference is paid by the floating payer, and vice versa. Usually only the payment streams, not the principal, are exchanged, although physical delivery is becoming increasingly common. Swaps are sometimes done to hedge risks that cannot readily be hedged with futures contracts. This could be a geographical or quality basis risk, or it could arise from the maturity of a transaction.

- Compliance

The status achieved by a Participant when all requirements of this TA Change Compliance script have been satisfied.

- Consolidation

Generators will generally have a target energy output for any given time period, but not all will achieve this exact figure. Some will over-produce and some will fail to meet their target. Consolidation combines the partial or total outputs of a number of generators into one energy account so over- and under-producing accounts are combined to cancel each other out, resulting in a stable aggregate output.

Consolidation can be particularly attractive for generation sources that are less less predictable than conventional generation, such as wind generation. Consolidation works best when the causes of the variation in generation output are not related. For example a wind farms in the same region are likely to experience peaks and troughs in output at around the same time and so consolidation is more likely to magnified variations in output rather than smooth them out. By contrast, combining a wind generator, a combined heat and power plant and a biomass plant is likely to bring a more stable output.Under BETTA, generators and suppliers of electricity are incentivised to balance their physical and contractual positions. Under this incentive generators who produce more electricity than they are contracted to supply are paid for "spilling" the surplus electricity onto the grid. Likewise, generators who fail to supply the contracted amount of electricity must pay for this shortfall.

Generators who spill are paid a price for this excess that is generally lower than they would get in the open market. Those who have a shortfall have to pay a price that is generally higher than it would normally cost in the open market.Almost all smaller generators have contracts to consolidate their output, many with major generators or suppliers. These contracts generally include elements of embedded benefit and energy price and are not always explicit about how much benefit is specifically attributed to consolidation. Independent consolidators (those who do not own generation assets or demand) can offer the consolidation service by combining many smaller generators' output and specialising in value-added products.

- Consolidator

A party that buys the output of a number of generators and trades it in the wholesale market.

Also see: Consolidation

- Contango

Term used to describe an energy market in which the anticipated value of the spot price in the future is higher than the current spot price. When a market is in contango, market participants expect the spot price to go up. The reverse situation is described as backwardation.

- Contracted Position

Parties must notify their contracted position to the System Operator for each settlement period through the process of Contract Notification. A long contracted position indicates that a party has contracted more supply than demand and a short contracted position vice versa. Any difference between a participants contracted position and its metered position will result in that party being out of balance.

- Contract Notification

A contract notification details the volume of any energy bought and sold between participants. A single agent acts on behalf of both trading parties, and submits a single contract notification prior to gate closure.

- CoP

Code of Practice

- Correlation

A measure to the degree to which changes in two variables are related. Correlation ranges between plus one (perfect correlation - the same amount of movements in the same direction) and minus one (perfect negative correlation - the same amount of movement in opposite directions). Like volatility, it can be calculated from historical data, but such calculations are not necessarily good predictors of behaviour.

If the correlation between markets is known, an option position in one market can be offset against another with similar direction and volatility. This is advantageous, because it can circumvent difficult hedging environments and can reduce costs.

Correlation is also important for the pricing of some options, particularly those offering exposure to more than one market variable. The payout of a spread option or a yield curve option is based on the correlation between two underlying markets separated by space, tie or assets, while that of a quanto product will depend on the extent of the relationship between movements in the underlying and movements in the exchange rate.

- CoS

Change of Supplier

- C.O.T.

See Change of Tenancy

- Counterparty

Conventionally the parties to a trading agreement are called counterparties. This term is used rather than buyer/ seller as the buying/ selling roles sometimes reverse in trading.

- Counterparty Risk

The risk that a counterparty to a contract defaults and does not fulfil obligations.

- Crack Spread

A type of commodity-product spread involving the purchase of crude oil futures and the sale of gasoline and heating oil futures.

- CRC

See Carbon Reduction Commitment

- Credit Assessment Load Factor

Each BM Unit has a Credit Assessment Load Factor (CALF) value, which is a measure of their average generation/demand as a ratio of their maximum for the current BSC Season. These values are calculated seasonally for each BM Unit, and each Season’s values are published at the beginning of the preceding Season.

CALF is used in the Energy Indebtedness calculation along with Generation or Demand Capacity (GC/DC) until II data is available. An exception is for Interconnector BM Units and those Generation Units with Credit Qualifying status who instead use Physical Notifications during this period.

Further details on CALF and how it is calculated can be found at: https://www.elexon.co.uk/operations-settlement/balancing-mechanism-units/credit-assessment-load-factor/- Credit Risk

Credit risk, or default risk, is the risk that a financial loss will be incurred if counterparty to a (derivatives) transaction does not fulfil its financial obligations in a timely manner. It is therefore a function of the following: the value of the position exposed to default (the credit or credit risk exposure); the proportion of this value that would be recovered in the event of a default; and the probability of default. Credit risk is also used loosely to mean the probability of default, regardless of the value that stands to be lost.

- Credit Worthiness

Financial accountability.

- CSS

See - Central Switching Service

- Curve

A time-series of prices for near to longer-term products.

- DA

Data Aggregator – an accredited agent appointed by a supplier to collate and sum meter reading data.

- DA LEBA

Daily indices compiled by LEBA (London Energy Brokers Association). The Day Ahead Index is calculated using a volume-based, weighted average of all Day Ahead baseload trades executed in London by contributing brokers between 0700hrs and 0900hrs each day.

- Dark Spread

Represents the theoretical margin for a coal fired power plant. If a dark spread is positive, then the price of the power is higher than that of the fuel and the spread is profitable.

- Dataflow Management

Dataflow management in the retail electricity supply market is the process of managing flows sent between market participants to ensure there integrity. The process involves a series of validations and exceptions management. (More about Dataflow Management)

- Data Transfer Catalogue

The catalogue of data flows, data definitions and data formats in the form approved under the MRA. The DTC accommodates the inter-operational exchange of information enabling effective interface between industry participants.

Information regarding the DTC can be found at: http://dtc.mrasco.com/

- Day-ahead market

A form of spot market where products are traded for delivery in the following day.

- DC

Data Collector – agent appointed by a supplier to retrieve and verify meter readings data from electrical meters to include processing, validating and estimating.

- DCC

- Data Communication Company The Department of Energy and Climate Change (DECC) granted Smart DCC Ltd a licence in September 2013 to establish and manage the data and communications network to connect smart meters to the business systems of energy suppliers, network operators and other authorised service users of the network. Smart DCC Ltd is a wholly owned subsidiary of Capita plc. The data and communications infrastructure will: -operate consistently for all consumers regardless of their energy supplier -provide smart metering data to network operators in support of smart grids -allow authorised third parties to provide services to consumers who have granted them permission to use their data. Consumers can benefit by receiving energy services and advice on how to reduce their energy usage.

- DCUSA

See Distribution Connection and Use of System Agreement.

- Declared Net Capacity

The full definition is given in schedule 1 of The electricity class exemption order no.3270. The DNC is the maximum power available from a generating station on a continuous capability basis less any power used to run the station. In the case of solar, wind, tidal or wave power the physical maximum continuous power is multiplied by a factor reducing the effective DNC. The factors are: Tidal, wave 0.33; solar 0.17; and wind 0.43.

- De-energisation

The movement of any isolator, breaker or switch or the removal of any fuse whereby no electricity can flow.

- Degree-Day

A measure of the variation of one day's temperature against a standard reference temperature, typically 65 degrees Fahrenheit (18 degrees Celsius). Degree-days are used as a base for temperature-related weather derivative deals. There are both cooling degree-days (CDDs) and heating degree-days (HDDs). For example a firm take out a 30-day CDD swap with a reference temperature 65 degrees F, and the average temperature on each day is 70 degrees F. The company is then due 150 (30 x 5) degree-days multiplied by the sum of money agreed for each degree-days. If the firm had taken out an HDD swap, it would have owed the same amount of money.

- Demand Profile

The load shape, or pattern of energy usage over a given period of time, usually daily, seasonal or annual. Standard profiles take an assumed form of electricity usage in half hourly slots for every day of the year.

- Demand Side Response

Demand side response (DSR) - involves electricity users varying demand due to changes in the balance between supply and demand, usually in response to price.

- Derivative

A financial instrument derived from a cash market commodity, futures contract or other financial instrument. Derivatives can be traded on regulated exchange markets or over-the-counter. For example, energy futures contracts are derivatives of physical commodities, and options on futures are derivative of futures contracts.

- Designated Customer/Market

Customers who use less than 12,000 (with a few exceptions) units of electricity a year.

- Distributed Generation/ Generators

Generation plant that is connected to a distribution network, i.e. not to the transmission network.

- Distribution Business

An entity holding an Electricity Distribution Licence

- Distribution Connection and Use of System Agreement

The Distribution Connection and Use of System Agreement (DCUSA) was established as a multi-party contract between the licensed electricity distributors, suppliers and generators of Great Britain. It is concerned with the use of the electricity distribution systems to transport electricity to or from connections to them. The DCUSA replaced numerous bi-lateral contracts, giving a common and consistent approach to the relationships between these parties in the electricity industry. It is a requirement that all licensed electricity distributors and suppliers become parties to the DCUSA.

Information regading DCUSA can be found at: www.dcusa.co.uk

- Distribution Losses

Electricity lost in the distribution system.

- Distribution Network Operator

The owner and operator of the local distribution networks. The DNO holds a distribution licence for the provision of network services in a defined area, including connection to the system, metering and data services.

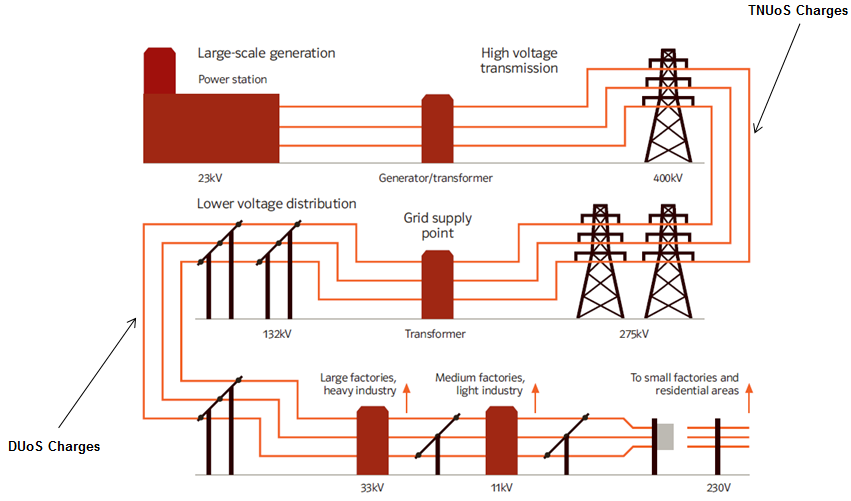

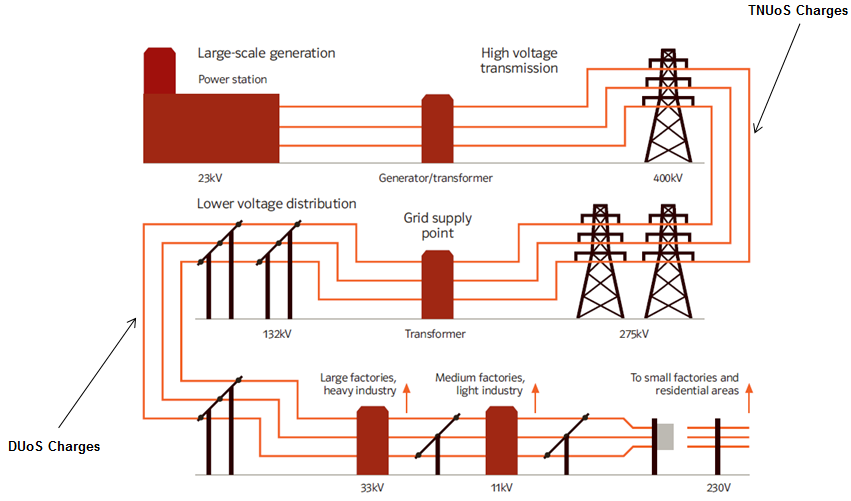

- Distribution Use of System

Distribution Use of System

The DUoS charge covers the cost of receiving electricity from the national transmission system and feeding it directly into homes and businesses through the regional distribution networks. These networks are operated by Distribution Network Operators (DNOs) such as Central Networks. The distribution networks include overhead lines and underground cables, as well as substations and transformers, which reduce the electricity’s voltage to safe levels for use in homes and businesses.

DUoS Tariffs can be found at:

https://www.energynetworks.org/electricity/regulation/distribution-charging/distribution-charges-overview.html

- DNC

See Declared Net Capacity

- DNO

See Distribution Network Operator

- DPC

Daily Profile Coefficient

- DSO

Distribution System Operator

- DSR

See - Demand side response

- DTC

See Data Transfer Catalogue

- DTN

Data Transfer Network – the electronic network provided to transmit all market participant data flows (as defined in the DTC) between parties.

- DUoS

See Distribution Use of System

- EAC

See Estimated Annual Consumption

- ECVAA

See Energy Contract Volume Aggregation Agent

- ECVNA

Energy Contract Volume Notification Agent

- EDIFACT

Electronic Data Interchange Format for Administration, Commerce and Transport.

- EELPS

Embedded Exemptible Large Power Station

- EEMPS

Embedded Exemptible Medium Power Station

- EESPS

Embedded Exemptible Small Power Station

- EEX

European Energy Exchange. An energy exchange based in Leipzig, Germany. EEX operates Spot and Derivatives Markets for energy and related products.

- EFA

Electricity Forward Agreement

- EFA Blocks

Six four hourly blocks within the EFA day (being 23.00 hours to 23.00 hours in the immediately following day).

- EFA Month

The EFA (Electricity Forwards Agreement) Calendar

- EHV

See Extra High Voltage

- ElectraLink

ElectraLink Ltd is the "Service Controller" responsible for the provision of the Data Transfer Service to all parties participating in the electricity retail market, under the terms of the Data Transfer Service Agreement. ElectraLink provides other commercial data transfer services to companies in the electricity and gas industries. ElectraLink also provides the secretariat to support the gas industry's Supply Point Administration Agreement and SPAA Ltd.

Information regarding Electralink services can be found at: www.electralink.co.uk

- Electricity Billing Systems

IT software application used for the production of electricity bills to consumers. In the UK, an electricity supplier is a retailer of electricity. For each supply point the supplier has to pay the various costs of transmission, distribution, meter operation, data collection, tax etc. The supplier then adds in energy costs and the supplier's own charge. (More about electricity billing systems)

- Electricity CRM System

Electricity Customer Relationship Management (CRM) System is an IT software application for managing a company’s interactions with customers and sales prospects. It involves using technology to organize, automate, and synchronize business processes. (More about Electricity CRM Systems)

- Electricity Forward Market

A brokered over-the-counter market in the UK for short-to-medium-term electricity derivative instruments, of which the most widely used is the electricity forward agreement.

- Electricity Market Reform

The EMR is the Government‘s approach to reforming the electricity system to ensure the UK‘s future electricity supply is secure, low-carbon and affordable.

- Electricity Pricing System

IT software application used by electricity supply companies for the purpose of creating quotations to consumers for the supply of electricity. (More about electricity pricing systems)

- Electricity Retail Supply Systems

The retail electricity supply business is a highly complex and extensively regulated market. Participants require an Electricity Retail Supply System (software application) to automate business processes and support interaction with customers. (More about Electricity Retail Supply Systems)

- Electricity Settlement Performance

Regulatory targets for electricity supplier’s settlement percentage are set and monitored by Elexon. Suppliers not achieving regulatory target incur regulatory financial penalties and impact the accuracy of customers’ bills.

The Balancing and Settlement Code (BSC) is a legal document which defines the rules and governance for the balancing mechanism and imbalance settlement processes of electricity in Great Britain.

ELEXON is known as the Balancing and Settlement Code Company (BSCCo).- Elexon

The Balancing and Settlement Code Company that manages the Electricity Trading Arrangements in England, Scotland and Wales.

- Elexon Charges

ELEXON’s costs and the contracted costs of BSC Agents are paid for by BSC Parties as described in Section D of the BSC. The amount each BSC Party pays (Funding Shares) depends on their market role and the volume of energy they generate, supply or trade.

Schedule of Charges: https://www.elexon.co.uk/guidance-note/schedule-main-sva-specified-charges/

Elexon charges information can be found at:

http://www.elexon.co.uk/bsc-related-documents/bsc-costs-charges/- Embedded Benefits

The additional value of electricity generated by a distributed generator arising from its connection to the distribution system rather than the transmission system. E.g. due to the avoidance of transmission and distribution losses.

Generators and suppliers directly connected to the electricity transmission grid pay charges for use of the network referred to as Transmission Network use of System Charges (TNUoS). As signatories to the Balancing and Settlement Code (BSC), generators incur other charges including Balancing Services use of System charges (BSUoS) and BSCCo costs.

Smaller generators which are not connected to the transmission network but to a distribution network and are not signatories to the BSC, are not subject to these charges. These benefits from being embedded in the distribution network are known as 'embedded benefits'.

Suppliers which contract with distributed generators use the national grid less and so incur reduced charges from National Grid Company. Suppliers can pass on these savings to distributed generators (subject to negotiation).

Transmission Network Use of System chargesTNUoS charges are paid by generators to and suppliers directly connected to the electricity transmission grid to National Grid Electricity Transmission (NGET) for use of the network. The charges vary for generators and suppliers according to their location and the demand for grid usage at that location.

Balancing Services Use of System (BSUoS) charges

BSUoS charges are paid by suppliers and generators based on their energy taken from or supplied to the National Grid in each half-hour Settlement Period. These charges are paid to NGET to cover the costs of keeping the system in electrical balance and maintaining the quality and security of supply.

Transmission Losses

About 1.5 per cent of the electrical energy generated in England and Wales is lost in the transmission system.

These losses increase with the distance the electricity has to travel. Under the British Electricity Trading and Transmission Arrangements (BETTA), the cost of transmission losses is recovered by effectively scaling down the metered output of generators and scaling up the energy imported by suppliers. These losses are presently recovered on a uniform basis and divided between generators and suppliers on a 45/55 split.

Where a generator is embedded within the distribution system both the generator and the associated demand it supplies, benefit from avoiding scaling for transmission losses.

BSC Cost Recovery and Participation Charges

Elexon – the company that runs the BSC imposes a variety of charges on BSC parties to enable it to recoup its operational and development costs. Charges are also levied on BSC parties based on the metered volumes credited to their accounts as a proportion of the total energy in the trading system. See the BSC for the full list of applicable charges.

Generator Distribution Use of System (GDUoS) charges

Charging methodologies have been produced by each Distribution Network Operator (DNO) setting out the basis for charging.- Embedded Generation

Generation plant that is connected to a distribution network, an older term for distributed generation.

- Emissions Trading Scheme

The emissions trading scheme of the European Union, based on an allocated "cap" for each operator with the ability to trade for insufficient of excess allocations.

- EMR

Electricity Market Reform

- ENA

See Energy Networks Association

- Energy

A measure of the amount of ‘work’ that can be done by, or is needed to operate, an energy conversion system, sometimes measured in ‘joules’ (J) or ‘Kilowatts hours’ (kWh).

- Energy Billing Software

IT software application used for the production of electricity bills to consumers. In the UK, an electricity supplier is a retailer of electricity. For each supply point the supplier has to pay the various costs of transmission, distribution, meter operation, data collection, tax etc. The supplier then adds in energy costs and the supplier's own charge. (More about Energy Billing Software)

- Energy Contract Volume Aggregation Agent

Energy contract volume aggregation agent under BETTA.

- energy Management System

An energy management system (EMS) is a system of computer-aided tools used by operators of electric utility grids to monitor, control, and optimize the performance of the generation and/or transmission system. The computer technology is also referred to as SCADA/EMS or EMS/SCADA.

- Energy Quoting Solution

IT software application used by electricity supply companies for the purpose of creating quotations to consumers for the supply of electricity. (More about Energy Quoting Solutions)

- Energy Savings Opportunity Scheme (ESOS)

Government established ESOS to implement Article 8 (4 to 6) of the EU Energy Efficiency Directive (2012/27/EU). The ESOS Regulations 2014 give effect to the scheme.

ESOS is a mandatory energy assessment scheme for organisations in the UK that meet the qualification criteria. The Environment Agency is the UK scheme administrator.

Organisations that qualify for ESOS must carry out ESOS assessments every 4 years. These assessments are audits of the energy used by their buildings, industrial processes and transport to identify cost-effective energy saving measures.

Organisations must notify the Environment Agency by a set deadline that they have complied with their ESOS obligations

- Energy Stack

The energy stack comprises of Bid Offer Acceptances in price order and is used to calculate the main energy imbalance price, once relevant tagging has been applied.

- EP

Entry Process

- EPC

Entry Process Co-ordinator

- Escrow Account

An account with something of value held within it under a third party to be retained until the occurrence of a contingency or a condition between two parties is met.

- ESOS

See - Energy Savings Opportunity Scheme

- Estimated Annual Consumption

An EAC is a projection of the annualised (12 month) consumption of a customer that does not have a half hourly metering system. It is derived from the metering system’s most recent meter advance and profile information. An EAC is used when the meter has not been read in the period between the Settlement Day in question and the Settlement Run.

- ET’s

Erroneous Transfer:

- ETS

See Emissions Trading Scheme

- EU ETS

European Union Emission Trading Scheme: The EU-wide greenhouse gas emissions trading scheme, under which governments must set emission limits for all large emitters of carbon dioxide in their country. Each installation is then allocated an allowance for the particular phase in question, with the first phase running from 2005 – 2007 and the second from 2008 – 2012. Installations may meet their cap by either reducing emissions below the cap and selling the surplus, or letting their emissions remain higher than the cap and buying allowances from other participants in the EU emissions market.

- Exchange

A type of platform on which power products are sold. Typically an exchange would allow qualifying members to trade anonymously with other parties and the risks between parties would be managed by a clearing service.

- Ex-PES

The previous Public Electricity Supplier for one of the 14 electricity regions in England, Wales and Scotland.

- Extra High Voltage

22,000 volts or higher voltage

- FAA

Fund Administration Agent - BSC Agent for Funds Administration in accordance with Section E1.2.4 of the BSC.

- Far Curve

Relates to the portion of the forward curve starting at the beginning of the front season.

- Faster Switching Programme

Ofgem’s Faster Switching Programme will deliver a number of reforms to the change of supplier arrangements, making change of supplier faster and more reliable for consumers. The reforms include the introduction of a new Central Switching Service (CSS) and a dual fuel Retail Energy Code (REC) to govern the new arrangements.

- The Feed-in Tariffs

The Feed-in Tariffs (FITs) scheme was introduced on 1 April 2010, under powers in the Energy Act 2008. Through the use of FITs, DECC hopes to encourage deployment of additional small-scale (less than 5MW) low-carbon electricity generation, particularly by organisations, businesses, communities and individuals that have not traditionally engaged in the electricity market.

Information regarding FIT can be found at DECC: http://www.decc.gov.uk/en/content/cms/meeting_energy/renewable_ener/feedin_tariff/feedin_tariff.aspx

- Financial contracts

Whenever a contract‘s value at maturity is settled with a monetary transaction.

- FIT

See Feed-in Tariffs

- Forward Price Curve

A projection of the future price of a commodity or financial instrument over time, usually based on actual transactions.

- FPN

Final Physical Notification

- Front Month

Gas or electricity for delivery in the first calendar month that occurs in the future. Also known as Prompt Month.

- Front Quarter

Gas or electricity for delivery in the first calendar quarter that occurs in the future. Also known as Prompt Quarter.

- Front Season

Gas or electricity for delivery in the first calendar season that occurs in the future. Also known as Prompt Season.

- Fundamentals

Factors other than psychological or technical that influence the price development on the physical or futures market, e.g. physical supply and demand, stock levels, currency exchange rates, interest rates, weather forecasts etc.

- Futures Contract

An exchange-traded supply contract between a buyer and a seller, whereby the buyer is obligated to take delivery of a fixed amount of a commodity at a predetermined price at a specified location. Futures contracts are traded exclusively on regulated exchanges are settled daily based on their current value in the market.

- Gate Closure

The point in time by which all Contract Notifications and Final Physical Notifications must be submitted for each settlement period. Parties should not change their positions other than through instruction by the SO after gate closure. It is currently set at one hour before the start of the relevant settlement period.

- Gateway

Means the combination of Gateway Hardware and Gateway Software.

- Gateway Hardware

Hardware installed by the Network Service Provider at the Users site for the operation of the Data Transfer Network.

- Gateway Software

Software provided by the Network Service Provider and installed on the Gateway Hardware to provide logical linkage between each User’s respective systems and the Data Transfer Network.

- GDUoS

Generator Distribution Use of System

- GEMA

Gas and Electricity Markets Authority

- Gemserv

Gemserv Limited is the service company established by the retail UK electricity market to provide governance management skills and expertise to utility markets as a whole.

- Geometric Mean

A measure of the average value of a set of numbers, sometimes viewed as a better measure of the true average than the arithmetic mean it is calculated as the nth root (where n is the number of observations) of the product of all observations.

- Gigawatt

A unit of power equal to 1 billion watts; 1 million kilowatts or 1000 megawatts.

- Gigawatt-hour

A unit of energy equal to million kilowatt-hours. 1 GWh is equivalent to the total electricity typically used by 250 homes in one year.

- Grid Trade Master Agreement

A Grid Trade Master Agreement (GTMA) is a legal agreement between the two parties in a trade that sets out terms in relation to financially settling the contract and physically delivering the power.

- GSP

Grid Supply Point – mean a meter connection point at which the transmission system is connected to a distribution system.

- GTMA

Grid trade master agreement (GTMA)

An industry standard trading agreement.

- GUI

Graphical User Interface

- GW

See Gigawatt

- Hedge

The initiation of a position in a futures or options market that is intended as a temporary substitute for the sale or purchase of the actual commodity. For example, the sale of futures contracts in anticipation of futures sales of cash commodities as a protection against possible price declines, or the purchase of futures contracts in anticipation of futures purchases of cash commodities as a protection against the possibility of increasing costs.

- Heren ICIS

A publisher of gas, power and carbon market information.

- HH

Half Hourly – means a Metering Point which provides measurements of supply of electricity on a half hourly basis.

All customers with a demand above 100kW (these are, broadly, customers that have a peak demand in excess of 100kW in any three months in a rolling 12 months period).

- High Voltage

A voltage exceeding 650 volts. It is the rated voltage above 1kV and medium voltage and is commonly used for distribution systems, with rated voltages above 1kV and generally applied to and including 52kV.

- HV

See High Voltage

- HVG

High Volume Gateway – Gateway Option designed to be connected by a Dedicated Connection intended for use by Users transferring more than 3.5 Mbytes of Traffic plus Local Traffic per day.

- IBC

Incentivised Balancing Cost

- ICE

Intercontinental Exchange

- I&C Sector

Industrial and Commercial sector. The non-domestic sector in general rather than any specific group of customers.

- IDNO

Independent Distribution Network Operator

- Imbalance

Energy imbalances are differences between the total level of demand and the total level of generation on the system within the half hour balancing period. The cash-out price aims to reflect the price of actions taken to solve energy imbalances, rather than those taken to solve system imbalances.

- Imbalance Price

Energy Imbalance Prices (or cash-out prices) - are applied to parties for their imbalances in each half-hour period. System Buy Price (SBP) is charged for short contracted positions. System Sell Price (SSP) is paid for long contracted positions.

- Incumbent

An incumbent is the company of the former monopoly supplier in a particular region. The incumbent in each region for electricity is known as the ex-PES. British Gas (Centrica) is the incumbent in the gas market.

- Initial Margin

A margin intended to cover within-day price volatility and is payable at the time the contract is entered into.

- Interconnector UK (IUK)

Natural gas pipeline linking the UK with continental Europe (Bacton in the UK with Zeebrugge in Belgium).

- Intermediary

Third party between two trading parties offering intermediation services.

- Intra-Day Market

Purchase and sale of a product within a given trading day.

- IPE

International Petroleum Exchange

- IPN

International Petroleum Exchange

- IS

Imbalance Settlement

- IWA

Initial Written Assessment

- Kilovolts

Kilovolts (kV)

Measurement of voltage (i.e. 1,000 volts)

- Kilowatt

A standard unit of electricity power equal to 1000 watts, or to the energy consumption at a rate of 1000 joules per second.

- Kilowatt-hour

A unit of energy. A typical home uses around 3,300 kWh of electricity.

- kVA

Kilo-Volt-Amperes

- kW

See Kilowatt

- kWH

See Kilowatt-hour

- LDSO

Licensed Distribution System Operator

- LEBA

See London Energy Brokers' Association

- LEC

See Levy Exemption Certificate

- LEG

Licence Exempt Generator

- LEGA

Licence Exempt Generator Agreement

- Letter of Credit (LoC)

A document issued by a financial institution, used in place in place of cash as collateral in particular where one of the counterparties have a weaker credit standing.

- Levy Exemption Certificate

Issued by Defra to "good quality" CHP to enable electricity to be supplied exempt from the Climate Change Levy.

- LF

See Load Factor

- Line Loss Factors

As energy travels from the point of production to the end user, some of it is ‘lost’ on the system. Under the BSC arrangements there are two ways in which these losses are accounted for:

•Losses on the low voltage Distribution Networks are allocated through the use of Line Loss Factors (LLFs).

•Losses on the high voltage Transmission System are allocated across BSC Parties through the use of Transmission Loss Multipliers (TLMs).Line Loss Factors (LLFs) are multipliers which are used to scale energy consumed or generated in order to account for losses on the UK’s Distribution Networks. There are two types of Line Loss Factor: Central Volume Allocation (CVA) LLFs and Supplier Volume Allocation (SVA) LLFs.

Information:

http://www.elexon.co.uk/reference/technical-operations/losses/Data:

All LLF data is published on the ELEXON Portal: https://www.elexonportal.co.uk- Liquidity

Liquidity is the ability to quickly buy or sell a product without causing a significant change in its price and without incurring significant transaction costs.

- Liquid Market

A market characterised by the ability to buy and sell with relative ease.

- LLF

See Line Loss Factor

- Load Factor

The Load Factor is the ratio of the average load to peak load. Load Factor is a measure of how variable a customer’s consumption is. A customer with a continuous demand at the same level will have a high load factor. A customer whose demand is generally very low but with large short duration peaks will have a low load factor.

Also see Maximum Demand.

- LoC

Letter of Credit (LoC) - A document issued by a financial institution, used in place in place of cash as collateral in particular where one of the counterparties have a weaker credit standing.

- London Energy Brokers’ Association

The London Energy Brokers' Association (LEBA) was formed in 2003 in affiliation with the Wholesale Markets Brokers' Association to represent wholesale markets broking firms active in the Over the Counter (OTC) and exchange traded UK and liberalised European energy markets.

LEBA Market Data Service

One of LEBA’s principle activities is the collection, validation and distribution of a rapidly growing set of aggregated transaction indexes and benchmark forward curves. These currently cover gas, power, coal and carbon, and have gained rapid industry acceptance due to a consistent methodology and their verifiable underlying transactions.- Market Asset Provider

A party that provides the relevant meter asset.

- Market Cash Out

The general term describing the system buy, system sell prices under BETTA and the buy price under the renewables obligation.

- Market Coupling

Market coupling is a method for integrating electricity markets in different areas, applied across a number of European countries.

- Market Domain Data

Market Domain Data is the central repository of reference data used by Suppliers, Supplier Agents and Licensed Distribution System Operators (LDSOs) in the retail electricity market. It is essential to the operation of Supplier Volume Allocation (SVA) Trading Arrangements. MDD is produced by the Supplier Volume Allocation Agent (SVAA) in the form of Data Transfer Network (DTN) flows D0269 (Market Domain Data Complete Set) and D0270 (Market Domain Data Incremental Set).

Information regarding the MDD can be found at: http://www.elexon.co.uk/reference/technical-operations/market-domain-data/

- Market Domain I.D.

A unique role identifier published by ISRA and/or SVAA which identifies a person by role and name and which can only exist on one gateway at any one time.

- Market Fundamentals

Factors that principally drive the market sentiment, i.e. demand, costs, outages, power stack, etc.

- Market Index Price

The Market Index Price (MIP) is used to set the reverse Energy Imbalance Price. It is calculated based on short term trading activity on exchanges. Currently the MIP is set based on selected trades undertaken on the APX and N2EX exchanges over a period of 20 hours before gate closure.

- Market Participant

An organisation that is currently approved for operation in the Trading Arrangements.

- Mark-to-Market

To mark-to-market is to calculate the value of a financial instrument (or portfolio of such instruments) at current market rates or prices of the underlying. Marking-to-market on a daily (or more frequent) basis is often recommended in risk management guidelines.

- Master Registration Agreement

The overall agreement which has to be signed by participants who wish to supply electricity to consumers.

- Maximum Demand

MD – the MD value is the largest of the half-hourly demand (kW) values recorded by the metering system during a period typically 12 months. MD metered customers are allocated to one of four Classes on the basis of a ‘load factor’ calculation.

The load factor (LF) measures the ‘peakiness’ of a customers annual demand shape. This value is equal to the customers actual annual consumption (kWh) divided by product of the MD value (kW) and the number of hours in a year (8,760 = 365 x 24), expressed as a percentage.

A customer with a low load factor has a relatively peaky profile.

The four MD Profile Classes are:

- Non-domestic MD with LF less than or equal to 20%

- Non-domestic MD with LF greater than 20% and less than or equal to 30%.

- Non-domestic MD with LF greater than 30% and less than or equal to 40%.

- Non-domestic MD with LF greater than 40%.

- MC

Measurement Class

- MCUSA

Master Connection and Use of System Agreement

- MD

See Maximum Demand

- MDD

Market Domain Data

- MDP

Maximum Delivery Period

- MDR

Maximum Demand Register

- MDV

Maximum Delivery Volume

- ME

Metering Equipment

- Megawatt

Standard measure of generating plant capacity equal to one thousand kilowatts, or one million watts. Medium to large power stations have capacity typically in the range of 500 MW to 2,00 MW.

- MEL

Maximum Export Limit

- Meter

A device for measuring Active Energy or Reactive energy.

- Meter Advance

The meter advance is the difference in the meter consumption between two sequential meter readings.

- Metered Position

The actual volume of electricity generated or consumed by a participant. It is the sum of the actual volume of electricity imported or exported at each BMU.

- Metering System Identifiers

Each metering system is allocated a unique identifier called Metering System Identifiers (MSIDs), and is made up of three components of the MPAN number Distribution Identifier, Unique Ref Number & Check Digit also know as MPAN Core No.

- Meter Standing Data

The data (as specified in the DTC) relating to the configuration of any metering equipment which is required to operate that equipment in an efficient manner.

- Meter Timeswitch Code

The MTC allows access to information which can be used for pricing purposes:

- TPR Count

- Standard Settlement Configuration

- Whether or not the meter has a tariff-related MPAN which should be registered

- Meter type (credit, prepayment etc.)

- Programmable or non-programmable

- Comms link Indicator (Yes/No)

- Status

Information available from this code is:

MTC Start MTC End Allocation 0 399 PES specific codes 400 499 Unmetered Supplies 500 799 Tariff – related MPAN Codes 800 999 Common Codes ‘Common Code’ is defined as a code which covers a large number of customers and can be covered by one or many supplies. If it is a PES specific code the MTC is unique to the PES and MTC 123 in EEB may not be the same as 123 in EMEB.

500 – 799 have tariff-related MPAN numbers. A tariff-related MPAN is defined as meaning two or more non-half hourly meters, at the same premises, billed to the same customer where either of the following conditions apply:

a. Where more than one meter is required to implement the tariff

b. Where a restricted hour/secondary meter exists.The MTC status code flag indicates if a MTC is New, Existing, Deleted, Updated since previous release or Warning – deleted at next release.

- Microgeneration

Microgeneration is the generation of zero or low-carbon heat and power by individuals, small businesses and communities to meet their own needs. Microgeneration refers to a number of different sustainable or highly efficient fossil fuel technologies that can generate heat and/or electricity in the domestic and commercial sector. Some forms of micro power use fuels or energy sources that produce no greenhouse gases and are therefore, classed as renewable energy, thus helping to combat climate change. Wind turbines, micro-hydro systems, heat pumps and Micro-Combined Heat and Power [CHP] are just three of the many types of small scale generation technologies which can help to attain at least two of the energy policy objectives; reductions in CO2 emissions and reliability of supply.

- MID

Market Index Data

- MIL

Maximum Import Limit

- MIP

See - Market Index Price

- Monitoring and Targeting

The purpose of monitoring and targeting (M&T) is to relate your energy consumption data to the weather, production figures or other measures in such a way that you get a better understanding of how energy is being used. In particular, it will identify if there are signs of avoidable waste or other opportunities to reduce consumption.

Data collection may be manual, automated, or a mixture of the two. Once an M&T scheme has been set up, its routine operation should be neither time-consuming nor complex. An M&T scheme will provide essential underpinning for your energy management activities.

- MOP

Meter Operator – means an Accredited agent appointed by a supplier, or, where applicable, a customer to:

(i) install, commission, test, repair and maintain metering equipment; and

(ii) maintain related technical information.

- MPAN

Metering Point Administration Number: Unique National, 13 digit number Reference for a Metering System. The MPAN must be on all suppliers’ customers’ invoices.

- MPAS

Meter Point Administration Service

- MPID

Market Participant ID

- MPR

Meter Point Reference

- MRA

The MRA is the multi-party agreement that all Ofgem licensed Suppliers and Distribution Business enter into that governs the essential interactions between them when retail customers wish to change their supplier from one company to another.

- MRASCo

MRASCo is the "not for profit" company funded by MRA parties and established under the MRA that provides, either directly or through contracts, the secretariat services that are required to administer the MRA and undertake any development activities required by the UK retail electricity market.

- MRASCo Dataflow

Dataflows are sent between market participants over the Data Transfer Network. The DTC accommodates the inter-operational exchange of information enabling effective interface between industry participants. See MRASC0 DTC or (More about MRASCo Dataflow)

- MRASCo DTC

The MRASCo Data Transfer Catalogue – DTC document the formats and structure of dataflows that accommodates the inter-operational exchange of information enabling effective interface between industry participants. (More about MRASCo DTC)

- MRoCoS

The meter reading issued for use as the initial meter reading for the New Supplier and the final meter reading for the Old Supplier on a change of supply.

- MSID

See Meter System Identifier.

- M&T

Monitoring and Targeting

Energy monitoring and targeting (M&T) is an energy efficiency technique based on the standard management axiom stating that “you cannot manage what you cannot measure”. M&T techniques provide energy managers with feedback on operating practices, results of energy management projects, and guidance on the level of energy use that is expected in a certain period.

- MTC

Meter Timeswitch Code

- MtC

Million tonnes of Carbon.

- MTD

Meter Technical Details – as per the D0149 & D0150

- MVRNA

Meter Volume Reallocation Notification Agent

- MW

Megawatt

- MWh

Megawatt-hour

- MZT

Minimum Zero Time

- N2EX

The N2 Exchange, a recently established GB electricity market platform, which is operated by Nasdaq OMX and Nord Pool Spot AS.

- NAO

National Audit Office

- National Balancing Point

A theoretical point within the National Transmission System (NTS) where gas is traded on the wholesale market.

- National Grid

Another name for the transmission network.

- National Grid Company

The company that owns the transmission system in England and Wales and operates the balancing mechanism for the whole of Great Britain.

- NBP

See Naational Balancing Point

- NCG

See National Grid Company

- Near Curve

Relates to the period of the forward curve running from the front month to the beginning of the front season.

- Netting Off

The process by which the grossed up output of a distributed generator is deducted from a supplier's total take within a GSP group.

- Network Service Provider

DTN operator and service provider.

- NFPA

Non-Fossil Purchasing Agency

- NHH

Non-Half Hourly – means any Metering Point, which provides measurements of supply of electricity other than on a half hourly basis.

Customers with a demand below 100kW.

Non-half hourly meters are read monthly, quarterly, six monthly, or annually.

- NISM

Notification of Inadequate System Margin

- NIV

Net Imbalance Volume

- Non-designated customer

Customers who use over 12,000 units of electricity a year with maximum demand of less than 100 kW pa. Customers will also be classed as non-designated customers, even though they use less than 12,000 units a year, if they:

- Have un-metered supply

- Have maximum demand metered

- Have half-hourly metering

- Are covered by a multi-site contract which includes some non-designated sites

- Non-fossil Fuel Obligation

The main instrument for encouraging the development of renewable generation prior to the introduction of the Renewables Obligation.

- Non-physical market participants

Participants who prefer to trade out positions ahead of delivery. Non-physical market participants usually trade for speculative purposes.

- Nord Pool

Nord Pool, the Nordic Power Exchange, a single power market for Norway, Denmark, Sweden and Finland.

- Notional Balance Point

The (notional) point at which all electricity is traded in Great Britain.

- Objection

When attempting to register a new customer with a registration notice to takeover supply, the current supplier objects to Electricity Directs request for transfer.

- OCM

On the day commodity market. This market enables anonymously financially cleared on the day trading between market participants.

- Off-peak

Period of relatively low system demand. These periods often occur in daily, weekly, and seasonal patterns; these off-peak periods differ for each individual electric utility.

- Ofgem

Office of Gas and Electricity Markets

- On-site

Refers to the consumption of electricity produced by a generator on, or immediately adjacent to the physical site occupied by the generator without use of either a private network or the DNOs network.

- Option

A contract that gives the purchaser the right, but not the obligation, to buy or sell the underlying commodity at a certain price (the exercise, or strike price) on or before an agreed date.

- Over-the-counter (OTC)

An over-the-counter deal is a customised derivative contract usually arranged with an intermediary such as a major bank or the trading wing of an energy major, as opposed to a standardised derivative contract traded on an exchange. Swaps are the commonest form of OTC instruments.

- P272

P272 requires that all maximum demand meters (Profile class 05-08) who have an AMR (Automatic Meter Reading) meter fitted will need to be settled on actual Half Hourly (HH) consumption data in the same way that Half Hourly meters (profile 00) are currently settled. Currently settlement occurs using an industry wide forecast that is pre-determined in order to allocate electricity volumes to each supplier.

- PAA

Performance Assurance Administrator

- PAB

Performance Assurance Board

- PAF

Post Office Address Format

- PAR

Price Average Reference

- Participant

The organisation (Supplier, LDSO, Supplier Agent or SMRS) undertaking Entry Processes.

- PC

Profile Class

- Peakload

Refers to power delivered during the period of peak system demand, usually working days from 7am to 7pm in the UK and excluding weekends and bank holidays. Due to the increase in demand, the power traded for availability at this time is ordinarily sold at a premium and tends to rely heavily on plant, which can be rapidly brought online, including coal and pumped storage facilities. The introduction of additional gas or electricity to cover this demand is known as peak shaving.

- PES

Public Electricity Supplier – means a supplier which held or is a successor to a company which held a PES Supply Licence at the BSC effective date. There are 14 Public Electricity Suppliers, two in Scotland and 12 in England and Wales.

PES Region PES Name GSP Group EELC A Eastern Electricity EMEB B East Midlands Electricity HYDE P Scottish Hydro Electric London C London Electric MANW D Manweb MIDE E Midlands Electricity NEEB F Northern Electric NORW G Norweb SEEB J Seeboard SOUT H Southern Electric SPOW N Scottish Power SWAE K South Wales Electricity SWEB L South Western Electricity YELG M Yorkshire Electricity - PES Registration System

See MPAS & PRS

- PGBT

Pre-Gate Closure Balancing Trade

- Photovoltaic (PV)

Direct conversion of solar radiation into direct current electricity by the interaction of light with the electrons in a semiconductor device or cell.

- Physical Market Participants

Generators and suppliers. Generally, physical market participants sell/buy energy forward and use spot and prompt (close to delivery) markets to fine tune their position.

- Physical Market Participants

Generators and suppliers. Generally, physical market participants sell/buy energy forward and use spot and prompt (close to delivery) markets to fine tune their position.

- PPA

Power purchase agreement.

- PPP

Pool Purchase Price

- Price Average Reference

Price Average Reference (PAR) - the volume of electricity from the energy stack (taken in descending price order) included in the calculation of the Main Price. PAR is currently set to 500 MWh. The PAR volume is always the most expensive 500 MWh of available electricity in the main stack.

- Private Networks

Electricity distribution arrangements that are not owned by a DNO and that are exempt from having to have a distribution licence.

- Profile Class

00 Half hourly metering point

01 Domestic, unrestricted (single rate)

02 Domestic, Economy 7

03 Non Domestic, non-max demand, unrestricted (single rate)

04 Non Domestic, non-max demand, Economy 7 (multi-rate)

05 Non Domestic, max demand, load factor 0-20%

06 Non Domestic, max demand, load factor 20-30%

07 Non Domestic, max demand, load factor 30-40%

08 Non Domestic, max demand, load factor 40-100%- Profile Class Threshold

The consumption thresholds are:

Profile Class Advance Threshold (kWh) 01 160,000 02 110,000 03 200,000 04 140,000 05 220,000 06 320,000 07 430,000 08 690,000 - Prompt Market

Gas or electricity for delivery within the current calendar month. Gas includes Within Day, Day Ahead, Weekend and BOM contracts. Electricity includes the Day Ahead and Week Ahead contracts.

- Prompt Trading

Refers to trading for delivery between (but not including) within-day trading and the next month (front month). This includes a number of products, including for delivery in the following day (e.g. day-ahead), weekend, weekdays, and trades for the balance of week and balance of month.

- PRS

PES Registration System – see MPAS

- PSP

Pool Selling Price

- PTF

Power Trading Forum

- Put Option

An option giving the buyer, or holder, the right, but not the obligation, to sell a futures contract at a specific price within a specific period of time in exchange for a one-off premium payment. It obligates the seller, or writer, of the option to buy the underlying futures contract at the designated price, should the option be exercised at that price. In an energy derivatives contract, the settlement price of the contract based on a particular location or particular blend of the commodity.

- PX

Power Exchange

- Rangebound

Where market conditions support neither a rise or fall in prices, therefore they stay at a similar level.

- RCRC

See Residual Cashflow Reallocation Charge

- RDRE

Ramp Down Rate Export

- RDRI

Ramp Down Rate Import

- Reactive Power

The product of voltage and current sand the sine of the phase angle between them, measured in units of voltamperes reactive and standard multiples thereof.

- REC

Regional Electricity Company

- Recycling (Renewables Obligation buyout)

The method for distributing the buy-out payments collected from suppliers who did not meet their Renewables Obligation targets and re-distributing it, in proportion to their share of all the Rocs redeemed that year.

- Registered Capacity

Full load capability of a generating unit as declared by the generator, less the energy consumed through the unit transformer.

- REGO

See Renewable Energy Guarantee of Origin

- Renewable

Energy from sources which occur naturally and repeatedly in the environment, e.g. from the sun, the wind and the oceans, and from plants and the fall of water. The energy available from waste is also included in some applications.

- Renewable Energy Guarantee of Origin

A certificate that specifies the origin of renewable energy. Used to demonstrate the pedigree of renewable power. Separate to Rocs, which are redeemed by suppliers.

- Renewable Heat Incentive

The Renewable Heat Incentive (the RHI) is a payment system in England, Scotland and Wales, for the generation of heat from renewable energy sources. Introduced on 28 November 2011, the RHI replaces the Low Carbon Building Programme, which closed in 2010.

The RHI operates in a similar manner to the Feed-in Tariff system, and was introduced through the same legislation - the Energy Act 2008. In the first phase of the RHI cash payments are paid to owners who install renewable heat generation equipment in non-domestic buildings: Commercial RHI.

The RHI went live on 28 November 2011 for non domestic buildings

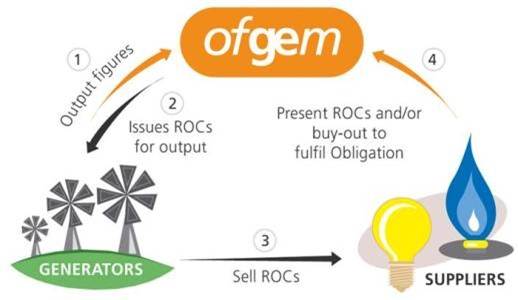

- Renewables Obligation

The RO places a mandatory requirement on licensed UK electricity suppliers to source a specified and annually increasing proportion of electricity they supply to customers from eligible renewable sources or pay a penalty. The scheme is administered by Ofgem who issue Renewables Obligation Certificates (ROCs) to electricity generators in relation to the amount of eligible renewable electricity they generate. Generators sell their ROCs to suppliers or traders which allows them to receive a premium in addition to the wholesale electricity price.

Suppliers present ROCs to Ofgem to demonstrate their compliance with the obligation. Where they do not present sufficient ROCs, suppliers have to pay a penalty known as the buy-out price. This is set at £40.71 per ROC for 2012/13 (linked to RPI). The money collected by Ofgem in the buy-out fund is recycled on a pro-rata basis to suppliers who presented ROCs. Suppliers that do not present ROCs pay into the buy-out fund at the buy-out price, but do not receive any portion of the recycled fund.

Information regarding RO can be found at: http://www.ofgem.gov.uk/Sustainability/Environment/RenewablObl/Pages/RenewablObl.aspx

- Renewables Obligation Certificate

The tradable certificates given to generators producing power from renewable energy sources. These certificates are used by suppliers to meet their Renewables Obligation commitment.

The RO places a mandatory requirement on licensed UK electricity suppliers to source a specified and annually increasing proportion of electricity they supply to customers from eligible renewable sources or pay a penalty. The scheme is administered by Ofgem who issue Renewables Obligation Certificates (ROCs) to electricity generators in relation to the amount of eligible renewable electricity they generate. Generators sell their ROCs to suppliers or traders which allows them to receive a premium in addition to the wholesale electricity price.

Suppliers present ROCs to Ofgem to demonstrate their compliance with the obligation. Where they do not present sufficient ROCs, suppliers have to pay a penalty known as the buy-out price. This is set at £40.71 per ROC for 2012/13 (linked to RPI). The money collected by Ofgem in the buy-out fund is recycled on a pro-rata basis to suppliers who presented ROCs. Suppliers that do not present ROCs pay into the buy-out fund at the buy-out price, but do not receive any portion of the recycled fund.

- Residual Cashflow Reallocation Cashflow

Residual Cashflow Reallocation Cashflow (RCRC) is to cover balancing costs in the last 15 minutes before gate closure. The charge is for each half-hour, and may be positive or negative. For all Settlement Periods, the Total Residual Cashflow (TRC) is calculated as being the sum of all energy imbalance charges across all parties and accounts. This value represents the total amount of money to be redistributed (or collected) via the Residual Cashflow Reallocation Cashflow (RCRC). Each party will be allocated a Residual Cashflow Reallocation Proportion (RCRP) of the TRC for both of its accounts (Production and Consumption). AKA Beer Fund.

RCRC information can be found at: www.elexon.co.uk/ELEXON%20Documents/settlement_cashflows.pdf

- Reverse Price

There are two Energy Imbalance Prices, 'Main' and 'Reverse'. The Reverse Price is charged to parties out of balance in the opposite direction to the system. When the system is long, short parties pay the Reverse Price and vice versa. The Reverse Price is currently set to the Market Index Price.

- RHI

See - Renewable Heat Incentive

- Risk Management

Control and limitation of the risks faced by an organization due to its exposure to changes, in financial market variables, such as foreign exchange and interest rates, equity and commodity prices, or counterparty creditworthiness.

It may be necessary because of the financial impact of an adverse move in the market variable (market risk); because the organization is ill-prepared to respond to such a move (operational risk); because a counterparty defaults (credit risk); or because a specific contract is not enforceable (legal risk).

Market risks are usually managed by hedging with financial instruments, although a form may also reduce risk by adjusting its business practices (see natural hedge). While financial derivatives lend themselves to this purpose, risk can also be reduced through judicious use of the underlying assets - for example, by diversifying portfolios.

- RO

See Renewables Obligation

- ROC

See Renewables Obligation Certificate

- RPS

Revenue Protection Service

- RTFO

Renewables Transport Fuel Obligation

- RURE

Ramp Up Rate Export

- SAF

Standard Address Format

- SBP

See System Buy Price

- SD

Settlement Day

- Seasonal Time of Day

Season time of day tariff or pricing. The price varies according to the time of day and the season of the year.

- SEL

Stable Export Limit

- Settlement

Is the mechanism by which how much electricity supplier’s customers have consumed and the wholesale payments that are due by the supplier for each half hour of each settlement day.

- Settlement Agents

The process by which suppliers and generators agree how much electricity was traded, the value of the trades and by whom.

- SFIC

System Fault Information Centre

- Shale Gas

Shale gas is an "unconventional" fossil fuel, which means that additional procedures are required to extract it beyond regular drilling. Many such unconventional sources of oil and gas were formerly too difficult (or uneconomic) to extract until recent advances in drilling technology. A combination of directional drilling and a process called hydraulic fracturing have made accessible large amounts of natural gas locked up in the tight pores of shale formations at depths of 2 km or more. Recent successes in the United States have driven prospecting across Europe. In 2010, Cuadrilla Resources Holdings Limited ("Cuadrilla") began drilling near Blackpool in the Bowland Shale (which runs from Preston to the Irish Sea).