Glossary

- Rangebound

Where market conditions support neither a rise or fall in prices, therefore they stay at a similar level.

- RCRC

See Residual Cashflow Reallocation Charge

- RDRE

Ramp Down Rate Export

- RDRI

Ramp Down Rate Import

- Reactive Power

The product of voltage and current sand the sine of the phase angle between them, measured in units of voltamperes reactive and standard multiples thereof.

- REC

Regional Electricity Company

- Recycling (Renewables Obligation buyout)

The method for distributing the buy-out payments collected from suppliers who did not meet their Renewables Obligation targets and re-distributing it, in proportion to their share of all the Rocs redeemed that year.

- Registered Capacity

Full load capability of a generating unit as declared by the generator, less the energy consumed through the unit transformer.

- REGO

See Renewable Energy Guarantee of Origin

- Renewable

Energy from sources which occur naturally and repeatedly in the environment, e.g. from the sun, the wind and the oceans, and from plants and the fall of water. The energy available from waste is also included in some applications.

- Renewable Energy Guarantee of Origin

A certificate that specifies the origin of renewable energy. Used to demonstrate the pedigree of renewable power. Separate to Rocs, which are redeemed by suppliers.

- Renewable Heat Incentive

The Renewable Heat Incentive (the RHI) is a payment system in England, Scotland and Wales, for the generation of heat from renewable energy sources. Introduced on 28 November 2011, the RHI replaces the Low Carbon Building Programme, which closed in 2010.

The RHI operates in a similar manner to the Feed-in Tariff system, and was introduced through the same legislation - the Energy Act 2008. In the first phase of the RHI cash payments are paid to owners who install renewable heat generation equipment in non-domestic buildings: Commercial RHI.

The RHI went live on 28 November 2011 for non domestic buildings

- Renewables Obligation

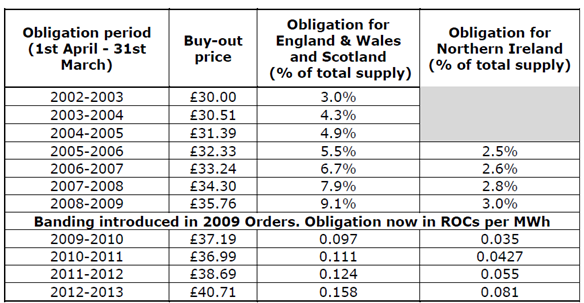

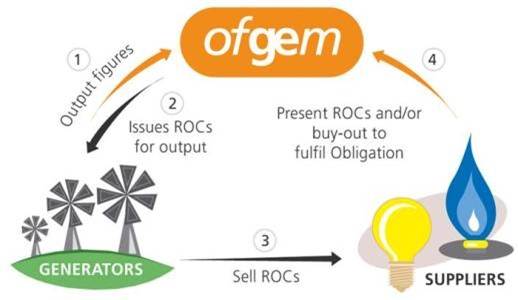

The RO places a mandatory requirement on licensed UK electricity suppliers to source a specified and annually increasing proportion of electricity they supply to customers from eligible renewable sources or pay a penalty. The scheme is administered by Ofgem who issue Renewables Obligation Certificates (ROCs) to electricity generators in relation to the amount of eligible renewable electricity they generate. Generators sell their ROCs to suppliers or traders which allows them to receive a premium in addition to the wholesale electricity price.

Suppliers present ROCs to Ofgem to demonstrate their compliance with the obligation. Where they do not present sufficient ROCs, suppliers have to pay a penalty known as the buy-out price. This is set at £40.71 per ROC for 2012/13 (linked to RPI). The money collected by Ofgem in the buy-out fund is recycled on a pro-rata basis to suppliers who presented ROCs. Suppliers that do not present ROCs pay into the buy-out fund at the buy-out price, but do not receive any portion of the recycled fund.

Information regarding RO can be found at: http://www.ofgem.gov.uk/Sustainability/Environment/RenewablObl/Pages/RenewablObl.aspx

- Renewables Obligation Certificate

The tradable certificates given to generators producing power from renewable energy sources. These certificates are used by suppliers to meet their Renewables Obligation commitment.

The RO places a mandatory requirement on licensed UK electricity suppliers to source a specified and annually increasing proportion of electricity they supply to customers from eligible renewable sources or pay a penalty. The scheme is administered by Ofgem who issue Renewables Obligation Certificates (ROCs) to electricity generators in relation to the amount of eligible renewable electricity they generate. Generators sell their ROCs to suppliers or traders which allows them to receive a premium in addition to the wholesale electricity price.

Suppliers present ROCs to Ofgem to demonstrate their compliance with the obligation. Where they do not present sufficient ROCs, suppliers have to pay a penalty known as the buy-out price. This is set at £40.71 per ROC for 2012/13 (linked to RPI). The money collected by Ofgem in the buy-out fund is recycled on a pro-rata basis to suppliers who presented ROCs. Suppliers that do not present ROCs pay into the buy-out fund at the buy-out price, but do not receive any portion of the recycled fund.

- Residual Cashflow Reallocation Cashflow

Residual Cashflow Reallocation Cashflow (RCRC) is to cover balancing costs in the last 15 minutes before gate closure. The charge is for each half-hour, and may be positive or negative. For all Settlement Periods, the Total Residual Cashflow (TRC) is calculated as being the sum of all energy imbalance charges across all parties and accounts. This value represents the total amount of money to be redistributed (or collected) via the Residual Cashflow Reallocation Cashflow (RCRC). Each party will be allocated a Residual Cashflow Reallocation Proportion (RCRP) of the TRC for both of its accounts (Production and Consumption). AKA Beer Fund.

RCRC information can be found at: www.elexon.co.uk/ELEXON%20Documents/settlement_cashflows.pdf

- Reverse Price

There are two Energy Imbalance Prices, 'Main' and 'Reverse'. The Reverse Price is charged to parties out of balance in the opposite direction to the system. When the system is long, short parties pay the Reverse Price and vice versa. The Reverse Price is currently set to the Market Index Price.

- RHI

See - Renewable Heat Incentive

- Risk Management

Control and limitation of the risks faced by an organization due to its exposure to changes, in financial market variables, such as foreign exchange and interest rates, equity and commodity prices, or counterparty creditworthiness.

It may be necessary because of the financial impact of an adverse move in the market variable (market risk); because the organization is ill-prepared to respond to such a move (operational risk); because a counterparty defaults (credit risk); or because a specific contract is not enforceable (legal risk).

Market risks are usually managed by hedging with financial instruments, although a form may also reduce risk by adjusting its business practices (see natural hedge). While financial derivatives lend themselves to this purpose, risk can also be reduced through judicious use of the underlying assets - for example, by diversifying portfolios.

- RO

See Renewables Obligation

- ROC

See Renewables Obligation Certificate

- RPS

Revenue Protection Service

- RTFO

Renewables Transport Fuel Obligation

- RURE

Ramp Up Rate Export