Energy Wholesale Market Review

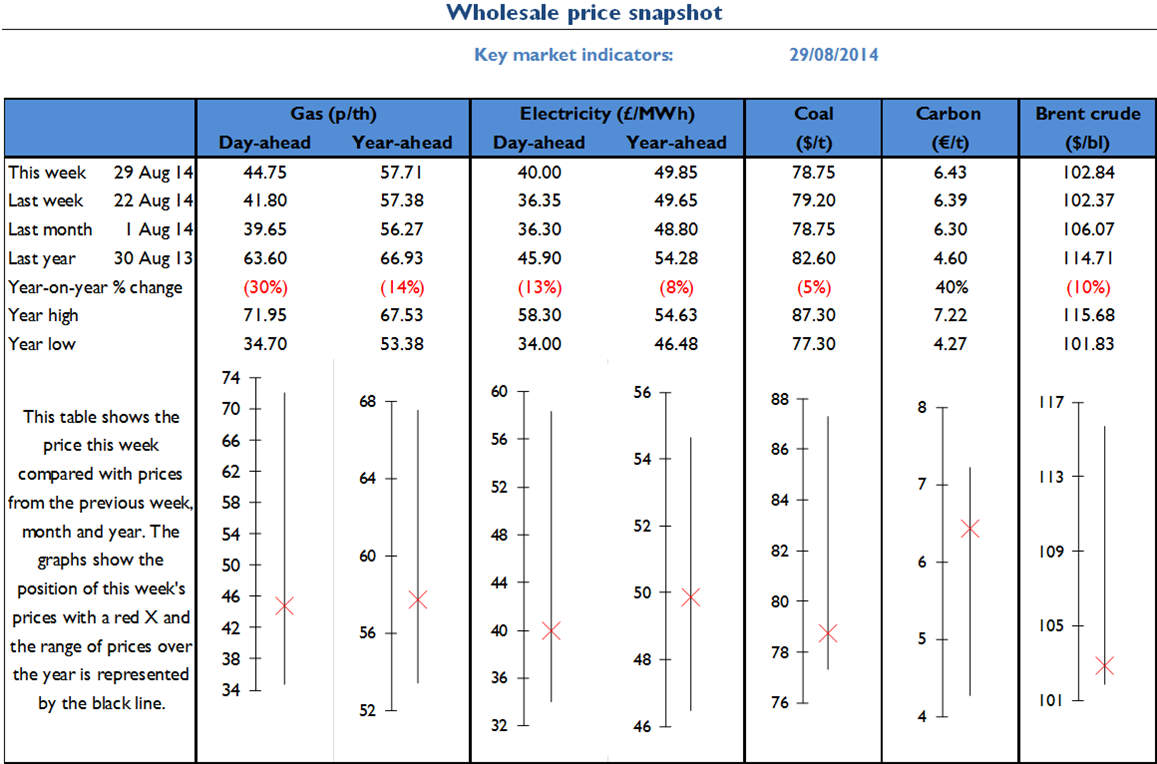

Energy Wholesale Market Review Week Ending 29th August 2014

Geopolitical tensions between Russia and Ukraine captured market focus this week and lead to volatile trends. Prices began the week on a downward trend following initial talks between the two nations, before a breakdown in negotiations and reports of Russian troops crossing the Ukrainian border sparked bullish sentiment in the market. Annual October 14 gas rose 0.6% to 57.7p/th, helping its power counterpart reach £49.9/MWh, as escalating conflict outweighed continued strong supply fundamentals. The prompt market was also impacted by the conflict, but more so by a tight gas market following maintenance for the Dutch BBL pipeline. Day-ahead gas climbed 7.1% week-on-week to a three-month high of 44.8p/th. In spreads, the annual October 14 clean spark spread dropped 1% to £4.8/MWh, as gas prices rose faster than power, while the annual clean dark spread lost 1.9% to reach £17.4/MWh. Commodities were more stable than the GB market, however geopolitical tensions did push Brent crude oil 0.5% to a weekly average of $102.7/bl. Coal prices were down 0.6% to $79.1/t and EU ETS carbon prices reversed recent trends to average €6.3/t, a 0.5% fall.

Energy Wholesale Market Review Week Ending 29th August 2014

Energy Wholesale Market Review Week Ending 22nd August 2014

The power market continued to follow trends seen in gas this week; movements were downwards as returning gas supplies, falling Brent crude oil prices and a strong supply outlook for the winter-ahead all influenced. Annual October 14 gas was down 3.8% to 57.4p/th as gas storage reached its highest level in seven years, its power counterpart followed lower, dropping to £49.65/MWh. Despite a 9% rise in gas demand, prompt prices also fell as the gas system remained well supplied and wind output was high. Day-ahead power dropped 7.7% week-on-week to £36.4/MWh. In spreads, the annual October 14 clean spark spread gained 5% to reach £4.9/MWh this week, as gas prices fell faster than power, while the annual clean dark spread lost 7% to reach £17.2/MWh. Commodities were also bearish, as coal and Brent crude oil continued recent downward trends. Brent crude oil dropped to a new 14-month low of $101.3/bl as US crude stocks remained at record highs. In contrast, limited supply at recent auctions pushed carbon prices to a five-month high of €6.4/t.

Energy Wholesale Market Review Week Ending 22nd August 2014

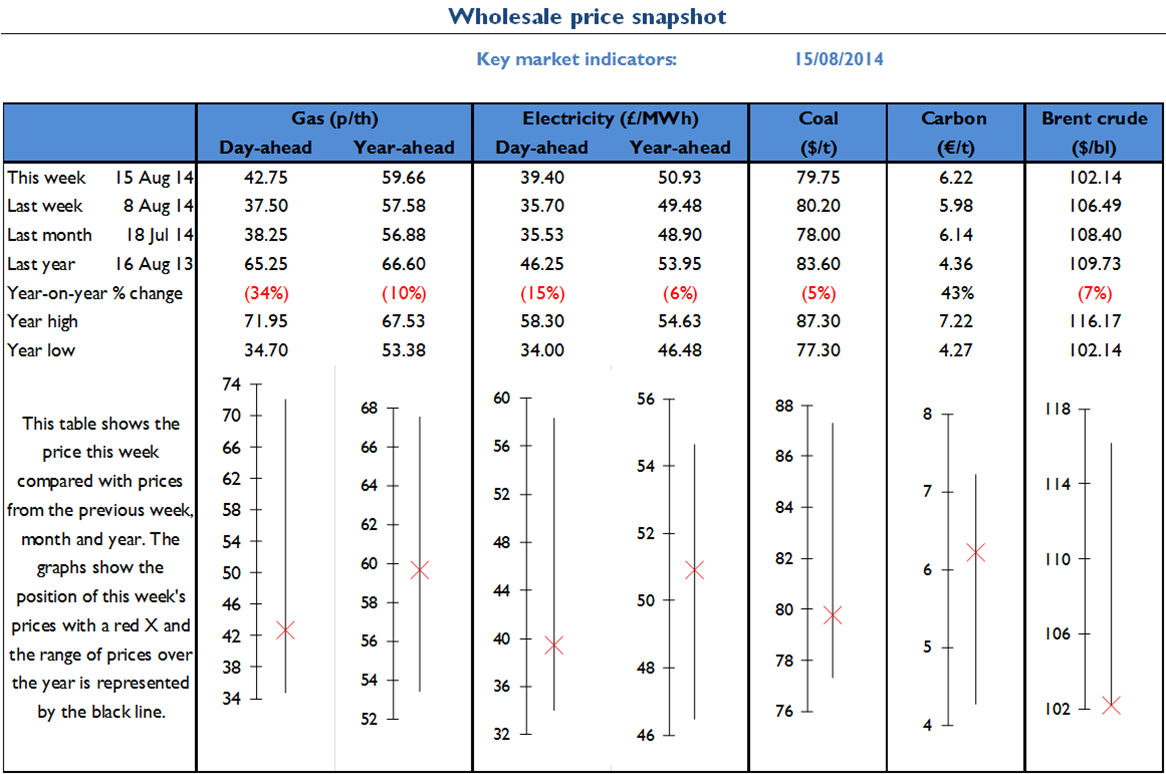

Energy Wholesale Market Review Week Ending 15th August 2014

New factors impacted GB power and gas contracts this week, as announcements of nuclear outages and supply cuts for the gas system combined with ongoing security of supply fears to raise prices. Reductions in nuclear output sparked capacity fears for the winter ahead, as annual October 14 power climbed 2.9% to a three-month high of £50.9/MWh. The outages also affected gas prices, as CCGT demand surged higher in the week. Gas prices also continued to be influenced by developments in Ukraine and by supply cuts from the UKCS and Norway. Day-ahead gas surged 14% higher week-on-week to a two-month high of 42.8p/th. In spreads, the annual October 14 clean dark spread lost 1% to reach £4.7/MWh as gas prices rose faster than power, while the annual clean dark spread gained 5% to reach £17.4/MWh. Commodities were mixed, especially when compared to the bullish GB market, as coal prices gained 1% to average $80/t while Brent crude oil prices lost 1.7% to settle at a 13-month low of $102.1/bl.

Energy Wholesale Market Review Week Ending 15th August 2014

Energy Wholesale Market Review Week Ending 8th August 2014

Most power and gas prices increased this week as a result of concerns over tensions between Europe and Russia and news the US will use airstrikes against militants in Iraq. Annual October 14 gas climbed 2.3% to 57.6p/th, helping to push its power counterpart up 1.4% to £49.8/MWh. In contrast, short-term contracts were down on good LNG supplies and rising wind forecasts; day-ahead power fell 1.7% week-on-week to £35.7/MWh. The annual October 14 clean dark spread gained 3.7% to reach £17.4/MWh, but the annual October 14 clean spark spread lost 2% to £4.7/MWh as gas prices rose further than power prices. Commodities were also bullish, with coal prices rising 0.4% to average $79.3/t and EU ETS carbon prices climbing 0.5% to a weekly average of €6.2/t. Despite the impacts of Russian sanctions, month-ahead Brent crude oil prices dropped 1.7% to a weekly average of $105.3/bl. However news on Friday of US intentions in Iraq pushed the price up $1.9/bl.

Energy Wholesale Market Review Week Ending 8th August 2014

Energy Wholesale Market Review Week Ending 1st August 2014

Diverging trends were seen this week for short and long-term contracts. News that EU sanctions would bypass the Russian gas sector helped reduce risks in the market, and high gas supply data once again drove prices lower. Winter 14 gas fell 0.5% to 58.4p/th, helping its power counterpart down 0.9% to £48.8/MWh. In contrast, short-term contracts were up on higher demand and constraints to daily gas supply, day-ahead power rose 0.8% week-on-week to £36.3/MWh. Annual spreads followed the falls in long-term contracts, as the annual October 14 clean dark spread lost 5.9% to reach £16.8/MWh. Commodities were more bullish than the GB market, with API 2 coal prices rising 0.5% to average $78.9/t and EU ETS carbon prices climbing to a four-month high of €6.3/t. Despite the impacts of Russian sanctions, month-ahead Brent crude oil prices were 0.4% lower over the week, and fell to a three-month low of $105.7/bl on Friday.

Energy Wholesale Market Review Week Ending 1st August 2014

Written By Graham Paul