Energy Wholesale Market Review

Energy Wholesale Market Review Week Ending 31st August 2018

All gas and power contracts rose this week, with contracts continuing to hit new highs amid bullish market fundamentals, including fresh 10-year high carbon prices, and rising coal and oil prices. EU ETS carbon prices increased 4.9% to average €20.5/t. Prices hit a fresh 10-year high of €21.8/t on 27 August amid low auction levels caused by the bank holiday on Monday. Day-ahead gas prices gained 4.1% to 69.3p/th. The contract hit a fresh five-month high of 70.4p/th on 30 August. Gas prices rose at the start of the week amid expectations of cooler temperatures in the following days, and were further supported by unplanned outages at gas facilities in Norway. Day-ahead power prices rose 2.7% to end the week up at £67.0/MWh, continuing to find support from rising commodity prices. All seasonal gas and power contracts increased, also hitting new highs this week. Seasonal gas contracts gained 2.0% on average. Winter 18 gas increased 2.2% to 73.1p/th. Seasonal power contracts went up 2.8% on average, with winter 18 power up 2.7% to £70.7/MWh. Brent crude oil prices climbed, lifting 2.5% to average $75.5/bl. Prices started the week up at $76.7/bl, before rising to $77.4/bl on 30 August following news that 2.6mn barrels were withdrawn from US crude stocks. API 2 coal rose 1.8% to average $91.0/t last week. Coal hit a fresh five-year high on 29 August at $93.3/t.

Energy Wholesale Market Review Week Ending 31st August 2018

Energy Wholesale Market Review Week Ending 24th August 2018

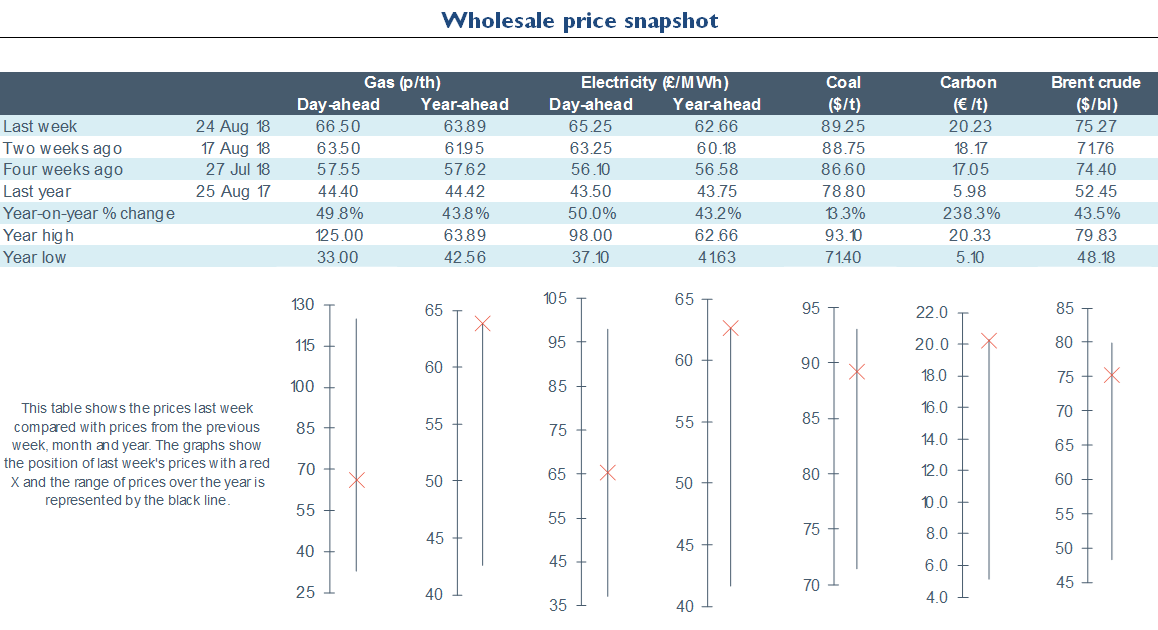

The majority of gas and power contracts rose this week, with contracts hitting fresh highs as bullish market fundamentals, including 10-year high carbon prices, and rising coal and oil prices, continued to give support. EU ETS carbon prices increased 8.0% to average €19.5/t this week. Prices hit a fresh 10-year high of €20.7/t on 23 August, finding support from strong prices across the energy complex and higher demand for fossil fuel generation amid continued nuclear outages in France. Day-ahead gas prices hit a fresh five-month high of 66.5p/th, up 4.7% as further strikes in the North Sea, and a reduction in flows from Norway, left the gas system undersupplied throughout the week. Day-ahead power prices rose 3.2% to end the week up at a fresh five-month high of £65.3/MWh, as low wind output is forecast throughout next week. Nearly all seasonal gas and power contracts increased, hitting fresh highs this week. Seasonal gas contracts gained 2.2% on average, with winter 18 gas increased 3.3% to 71.6p/th. Seasonal power contracts went up 2.7% on average, with winter 18 power up 3.8% to £68.8/MWh. Brent crude oil prices reversed the previous week’s losses, up 2.0% on average to $73.5/bl. Prices rose throughout the week in response to the upcoming Iranian sanctions, and news that US crude stockpiles decreased the previous week. API 2 coal rose 1.1% to average $89.4/t this week, hitting a one-month high on 21 August at $90.0/t.

Energy Wholesale Market Review Week Ending 24th August 2018

Energy Wholesale Market Review Week Ending 17th August 2018

All gas and power contracts rose this week, with all seasonal contracts hitting fresh highs as bullish market fundamentals, including 10-year high carbon prices and rising coal prices, continued to give support. EU ETS carbon prices increased 2.8% to average €18.1/t this week. Prices were supported by an announcement from the European Commission that German auctions will be postponed from 9 November until Q119, deferring the sale of 21.8 million allowances until next year. Day-ahead gas prices gained 7.6% to 63.5p/th, a five-month high. Prices have been influenced by high EU ETS carbon prices, upcoming strikes in the North Sea, and annual maintenance affecting Norwegian gas supplies. Day-ahead power prices rose 5.5% to end the week up at a fresh five-month high of £63.3/MWh, with higher gas prices and low wind output forecast for early next week. All seasonal gas and power contracts increased this week, hitting fresh highs on 17 August. Seasonal gas contracts gained 2.5% on average. Winter 18 gas increased 5.6% to 69.3p/th. Seasonal power contracts went up 2.3% on average. Winter 18 power was up 4.2% to £66.3/MWh. Brent crude oil prices fell for the fourth consecutive week, lowering 1.9% to average $72.1/bl. The announcement of an unexpected build in US crude stockpiles, up by 6.8mn barrels, led prices to drop below $70.5/bl on 15 August. API 2 coal rose 1.3% to average $88.4/t this week.

Energy Wholesale Market Review Week Ending 17th August 2018

Energy Wholesale Market Review Week Ending 3rd August 2018

The majority of gas and power contracts rose this week, as EU ETS carbon continued with bullish momentum to hit a fresh seven-year high. EU ETS carbon prices reached €17.8/t on 1 August, continuing to be supported by higher power demand across Europe this summer amid ongoing heatwaves sweeping the continent. Day-ahead gas prices gained 1.9% to 58.7p/th. This was despite demand for gas dropping 8.1% from last week and the gas system being largely oversupplied. Prices have been influenced by bullish EU ETS carbon prices. Day-ahead power began the week down due to rising levels of wind output. Prices ended the week up 6.3% at £59.7/MWh, with wind forecasted below 2.0GW at the start of next week. Nearly all seasonal gas and power contracts increased this week. Seasonal gas contracts gained 0.8% on average. Winter 18 gas was the exception, down 0.6% to 63.6p/th. Seasonal power contracts went up 0.7% on average. Brent crude oil slipped 0.2% to average $73.8/bl, down from $74.0/bl the previous week. Oil prices rose early in the week as Saudi Arabia suspended shipments through the Red Sea’s Bab al-Mandeb strait following attacks on ships from members of the Houthis movement, but fell following the announcement of an increase in US crude stocks. API 2 coal slipped 0.7% to average $86.1/t this week, despite strong demand from Asia as the heatwave continued across the region and increased power demand for cooling.

Energy Wholesale Market Review Week Ending 3rd August 2018

Written By Graham Paul