Energy Wholesale Market Review

Energy Wholesale Market Review Week Ending 12th April 2019

Wholesale power and gas contracts continued to move higher this week, driven by cooler temperatures and gas supply restrictions early in the week. Prices were also pushed higher by a surge in carbon prices, which rose to their highest level since September 2008. All baseload power contracts rose, following gas and carbon prices higher. Day-ahead power received extra support from weaker wind generation, with the contract gaining 3.4% to end the week at £45.8/MWh. Seasonal baseload power contracts rose 2.6% on average. The front season contract, winter 19 power, lifted 4.4% to £60.8/MWh. All near-term gas contracts rose this week, as colder temperatures lifted demand for heating and an outage at the Aasta Hansteen gas field restricted gas supplies. Day-ahead gas increased 3.5% to 39.5p/th, after hitting a four-week high of 41.0p/th on Tuesday 9 April. May gas edged 0.7% higher to 38.9p/th. Most seasonal contracts went up, rising 1.5% on average. Winter 19 gas experienced the biggest change, climbing 4.9% to 58.4p/th. Brent crude oil prices rose 2.9% to average $71.2/bl. Oil prices found support early this week amid concerns of supply disruptions in Tripoli, Libya, adding to supply risks from the US sanctions on Iran and Venezuela. API 2 coal prices gained 5.7% to average $74.8/t. EU ETS carbon prices jumped 13.2% to average €25.8/t. Prices ended the week at €27.0/t, their highest level since September 2008, supported by the extension to the UK’s EU departure date.

Energy Wholesale Market Review Week Ending 12th April 2019

Energy Wholesale Market Review Week Ending 5th April 2019

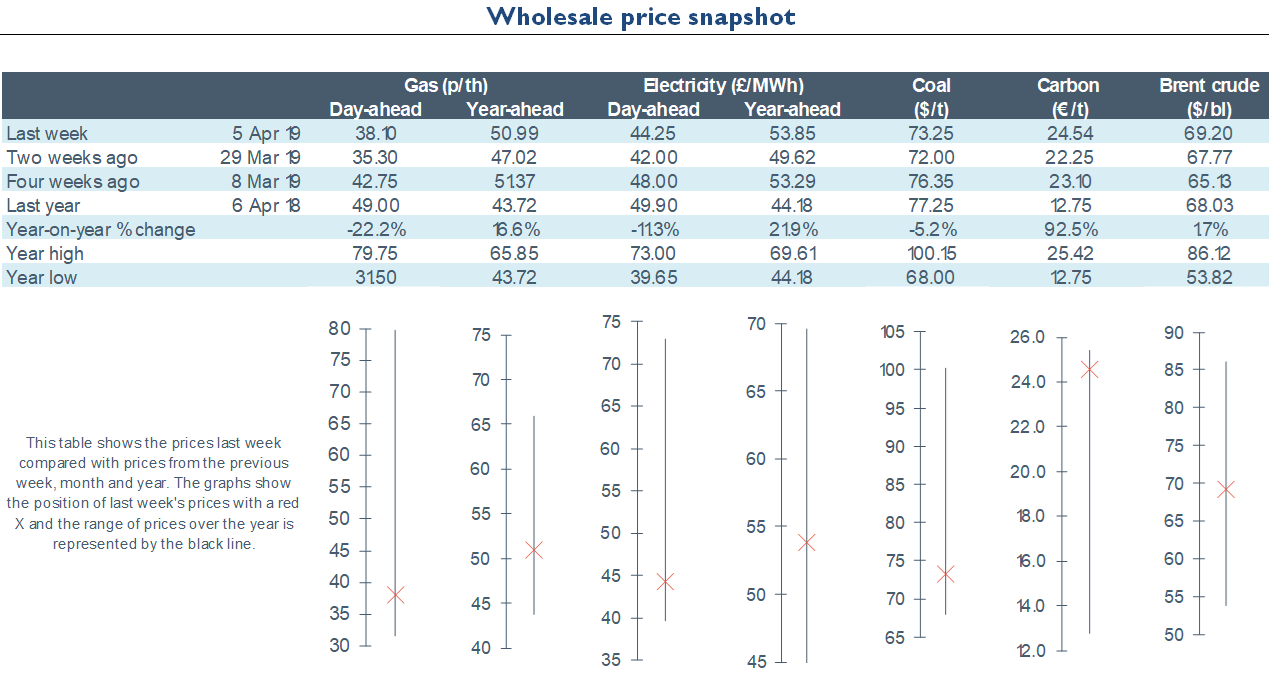

Wholesale power and gas contracts reversed recent trends and moved higher this week. Despite the arrival of seven LNG tankers during the first week of April, the gas system was undersupplied on Friday following a drop in flows from Norway. All baseload power contracts rose week-on-week, following gas counterparts up, while weaker wind generation also supported near-term contracts. A recovering EU ETS carbon market also drove prices up, gaining 5.6% to average €22.8/t. Day-ahead power was up 5.4% to end the week at £44.3/MWh. Earlier in the week the contract fell to a fresh 20-month low of £39.7/MWh. All seasonal power contracts rose, gaining 6.3% on average. All gas contracts rose week-on-week, as cooler temperatures lifted gas demand and an unexplained drop in flows from Norway on Friday led to an undersupplied system. Day-ahead gas increased 7.9% to end the week at a 38.1p/th. The contract had fallen to a fresh 22-month low of 31.5p/th on 3 April as the gas system was oversupplied following an influx of LNG tankers. All seasonal gas contracts went up, rising 6.8% on average, following Brent crude oil prices higher which gained 2.5% to average $69.2/bl. Oil prices found support from news that OPEC production cuts had taken the group’s output to a four-year low in March, with further support from waning Venezuelan production amid US sanctions and power outages. API 2 coal prices fell 4.3% to average $70.8/t, dropping to $68.0/t on 3 April, a 22-month low.

Energy Wholesale Market Review Week Ending 5th April 2019

Written By Graham Paul